Crypto Crackdown: Feds Intercept $200K Destined for Terror Funding

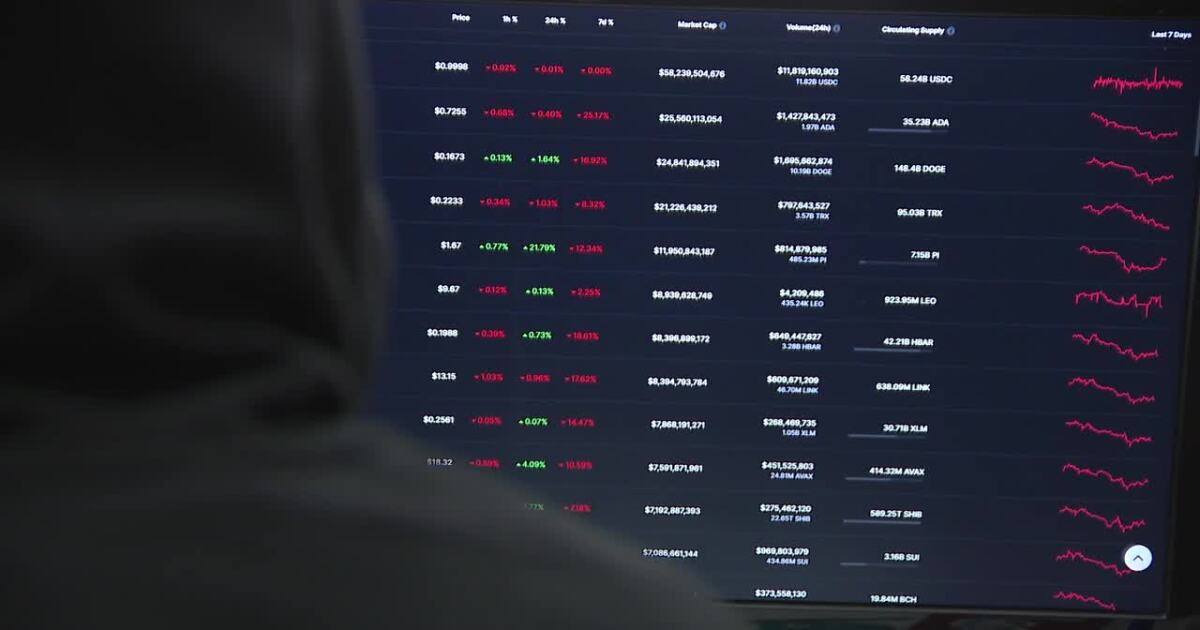

In a significant crackdown on digital financial fraud, the US Department of Justice has successfully dismantled an intricate cryptocurrency donation scheme that operated through encrypted communication channels. The sophisticated network utilized a complex web of digital wallets to funnel and launder funds, exploiting the anonymity of cryptocurrency transactions.

Investigators uncovered a carefully orchestrated system where anonymous actors leveraged encrypted chat platforms to solicit and transfer cryptocurrency donations. By using multiple interconnected wallets, the perpetrators attempted to obscure the origin and movement of digital funds, making traditional tracking methods challenging.

The DOJ's intervention highlights the growing challenges in regulating cryptocurrency transactions and preventing potential financial crimes in the digital landscape. This operation serves as a stark reminder that despite the perceived anonymity of blockchain technologies, law enforcement agencies are becoming increasingly adept at tracing and disrupting illicit financial networks.

While specific details of the investigation remain confidential, the successful disruption signals a strong message to potential cybercriminals: digital financial crimes are under intense scrutiny, and sophisticated tracking methods are continuously evolving to combat such schemes.