Cloud Computing Upstart CoreWeave Faces Wall Street Headwinds: IPO Challenges Loom Large

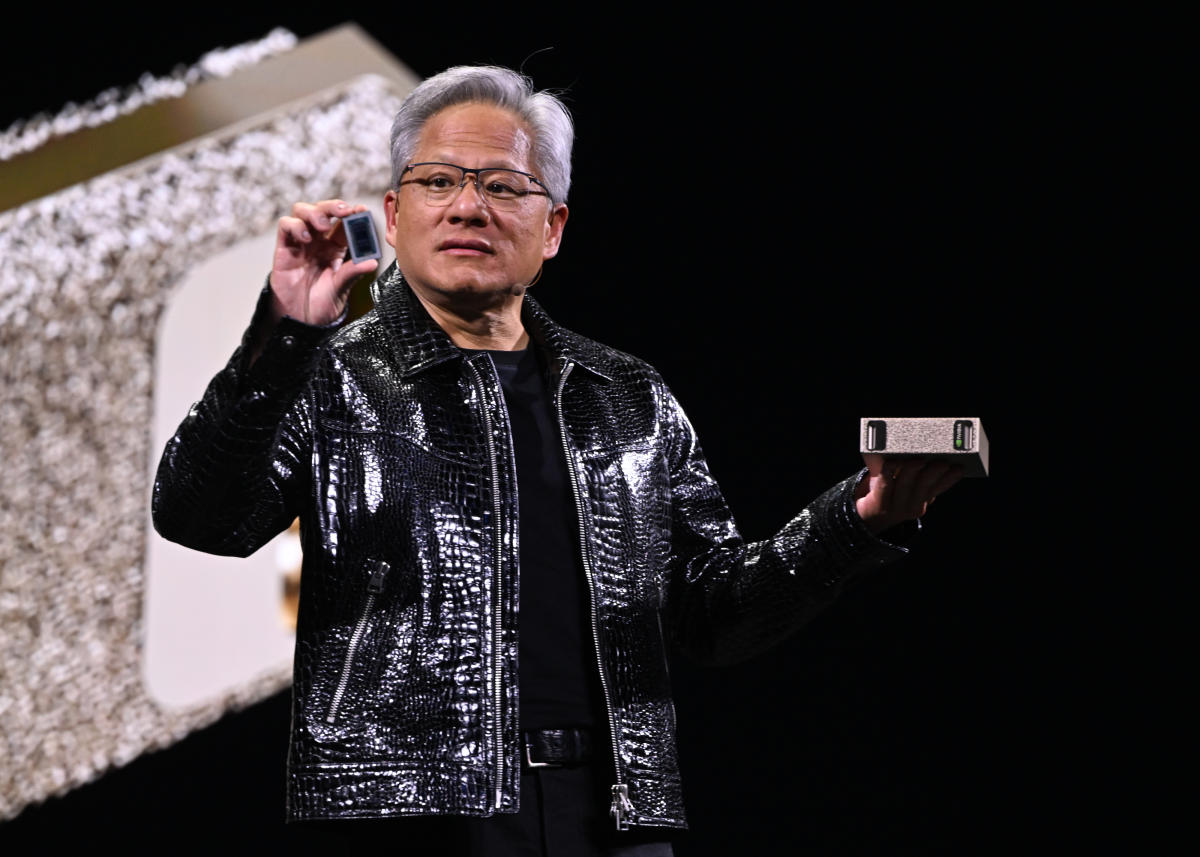

CoreWeave's impending public debut is casting shadows of uncertainty as mounting financial concerns and market challenges threaten to dampen investor enthusiasm. The AI infrastructure company, bolstered by Nvidia's backing, finds itself navigating treacherous waters as it prepares to go public amid a complex economic landscape.

Analysts are questioning the timing of CoreWeave's initial public offering (IPO), pointing to a confluence of market pressures that could potentially undermine its market entry. The company's strategic pivot comes at a moment when equity markets are experiencing significant volatility, complicated by ongoing tariff uncertainties and emerging competitive threats from Chinese AI innovators like DeepSeek.

Adding to the complexity, growing investor frustration with Big Tech's substantial AI investments and their delayed returns is casting a long shadow over CoreWeave's market prospects. The company's leadership now faces the critical challenge of convincing investors that their cloud services and data center infrastructure represent a compelling value proposition in an increasingly competitive technological ecosystem.

While CoreWeave's Nvidia connection provides some credibility, the company must carefully navigate market skepticism and demonstrate a clear path to profitability in an AI landscape that is rapidly evolving and increasingly crowded with ambitious competitors.