Crypto Titan Galaxy Digital Slapped with $200M Fine in Luna Fallout

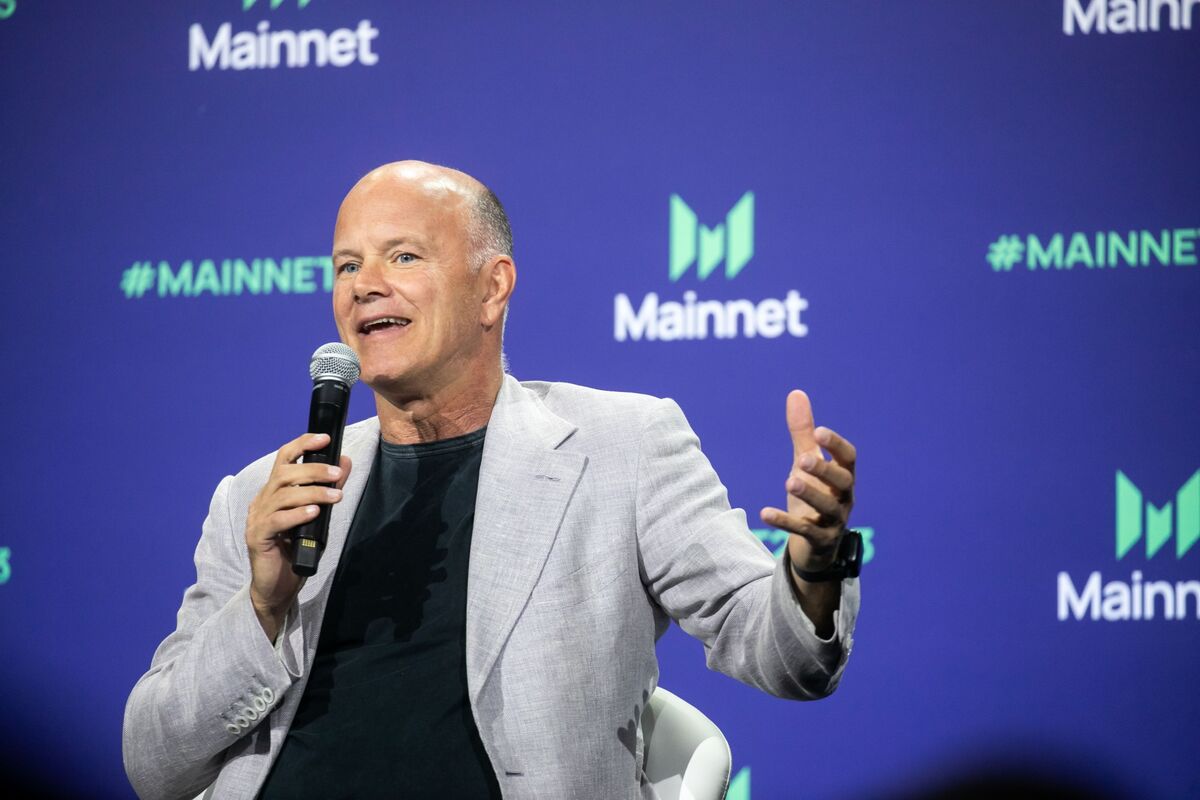

Cryptocurrency giant Galaxy Digital is set to pay a hefty $200 million penalty following its controversial involvement with the now-infamous Luna cryptocurrency. The settlement, reached with the New York Attorney General's office, marks a significant blow to the firm led by prominent crypto entrepreneur Michael Novogratz.

The substantial financial penalty stems from Galaxy Digital's role in promoting Luna, a cryptocurrency that spectacularly collapsed in 2022, causing massive financial losses for investors worldwide. This settlement underscores the increasing regulatory scrutiny facing cryptocurrency firms and their marketing practices.

Novogratz, a well-known figure in the crypto industry, has been closely associated with the Luna project and its parent company Terra, which imploded in one of the most dramatic financial meltdowns in recent cryptocurrency history. The $200 million penalty serves as a stark reminder of the potential consequences of aggressive crypto marketing and unverified investment claims.

The settlement not only represents a financial setback for Galaxy Digital but also signals a growing commitment from regulatory bodies to protect investors from potentially misleading cryptocurrency promotions. It highlights the need for greater transparency and accountability in the rapidly evolving digital asset landscape.