From Pocket Change to Crypto Jackpot: Trader's $2K PEPE Bet Explodes into $43M Windfall

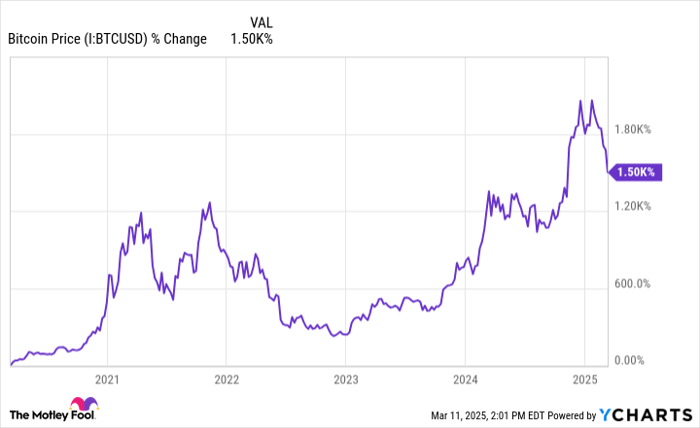

In a remarkable display of trading prowess, a cryptocurrency trader managed to secure an impressive $10 million profit, despite the Pepe meme coin experiencing a dramatic 74% decline from its peak value. This extraordinary achievement highlights the complex and volatile nature of the cryptocurrency market, where skilled traders can still find opportunities for significant gains even during substantial price downturns.

The trader's success underscores the importance of strategic trading and the potential for substantial returns in the highly unpredictable world of digital assets. By navigating the turbulent waters of the crypto market with precision and insight, this individual demonstrated that profitability is not solely dependent on rising prices, but can also be achieved through sophisticated trading techniques and market understanding.