Ethereum's Crypto Rollercoaster: ETH Tumbles to 5-Year Market Low, Trailing Bitcoin's Performance

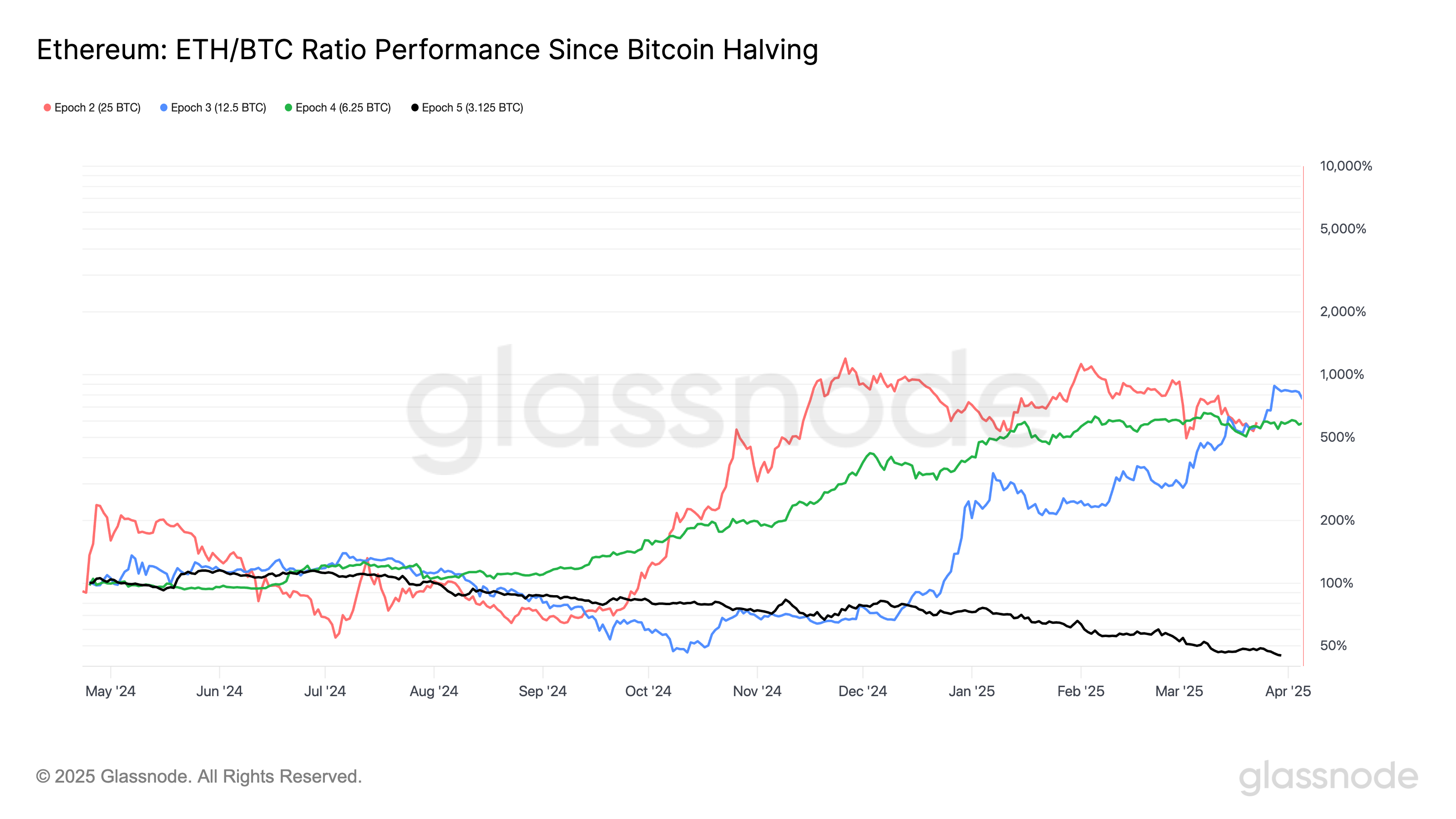

In a surprising turn of events, Ethereum has fallen behind Bitcoin in performance since last year's reward halving—a rare occurrence that's catching the attention of crypto investors and market analysts. This marks the first time Ether has underperformed its cryptocurrency counterpart in such a significant manner.

The shift represents a notable departure from Ethereum's previous market dominance, highlighting the dynamic and unpredictable nature of the digital asset landscape. Investors and blockchain enthusiasts are closely watching how this performance gap might evolve in the coming months.

While Bitcoin has maintained a stronger position, Ethereum continues to play a crucial role in the broader cryptocurrency ecosystem, particularly with its ongoing technological developments and the anticipated Ethereum 2.0 upgrades. The current performance disparity serves as a reminder of the volatile and ever-changing crypto market dynamics.