Crypto Crackdown: Arizona Moves to Shield Investors from Digital Fraud Wave

Arizona Takes Aim at Cryptocurrency Scams with New Legislation

In a bold move to protect consumers, Arizona lawmakers are stepping up to combat the rising tide of cryptocurrency fraud through proposed legislation targeting deceptive "crypto kiosks".

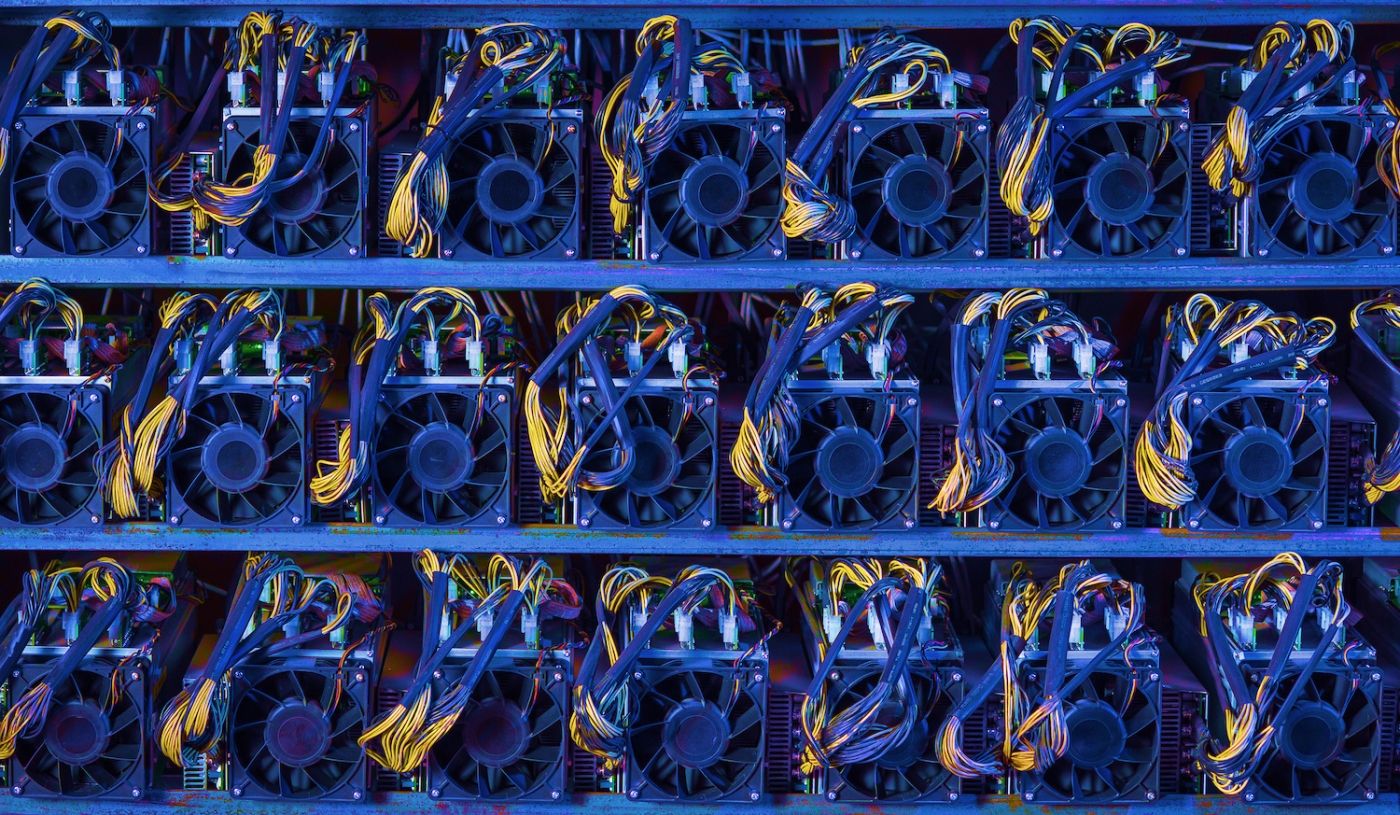

Brendon Blake, AARP Arizona's director of advocacy, is shedding light on a growing menace that preys on unsuspecting individuals. These seemingly innocuous kiosks, often tucked away in local businesses and shopping malls, have become hotspots for sophisticated scamming operations.

The scam typically unfolds with a calculated phone strategy: fraudsters pressure victims into withdrawing cash and depositing it into cryptocurrency machines. What makes these schemes particularly insidious is the decentralized nature of cryptocurrency, which creates a digital smokescreen that makes tracking transactions nearly impossible.

By introducing this bill, Arizona aims to create a protective barrier against these predatory practices, offering citizens a much-needed shield in the increasingly complex world of digital finance.

As cryptocurrency continues to evolve, legislative efforts like these represent a critical step in safeguarding consumers from emerging financial threats.