Market Mayhem: Bitcoin Tumbles as U.S. Tariff Shock Wipes $8.2 Trillion from Global Markets

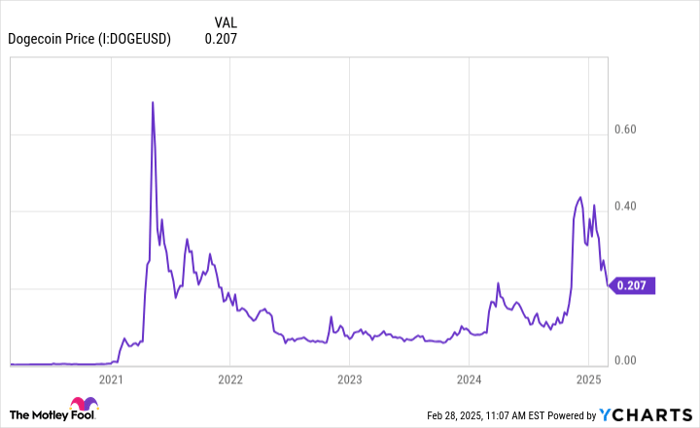

In a dramatic weekend market shift, Bitcoin experienced a sharp decline, plummeting below the $80,000 mark and shedding over 3% of its value in a mere two-hour window. The sudden downturn caught cryptocurrency investors and traders off guard, highlighting the volatile nature of the digital asset market.

The rapid descent underscores the ongoing volatility that continues to characterize Bitcoin's price movements. Investors and market analysts are closely monitoring the situation, seeking to understand the underlying factors driving this sudden price correction.

While such fluctuations are not uncommon in the cryptocurrency landscape, the speed and magnitude of this drop have sparked renewed discussions about market sentiment and potential short-term market pressures. Traders are advised to remain vigilant and prepared for potential further market movements.

As the cryptocurrency market remains dynamic and unpredictable, this latest price movement serves as a reminder of the inherent risks and opportunities present in digital asset investments.