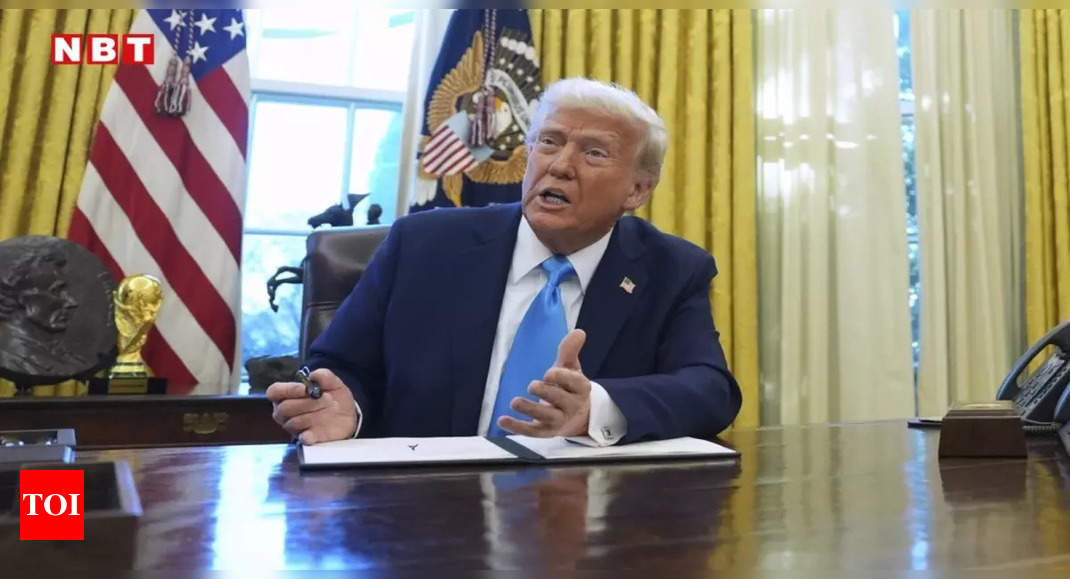

Crypto Markets Reel: Trump Tariffs Trigger Flashbacks to COVID Market Meltdown

Cryptocurrency Markets Reel: Tariff Tensions Trigger Market Turmoil

The cryptocurrency landscape is experiencing another dramatic downturn, with recent tariff-related tensions drawing stark parallels to the infamous COVID-19 market crash of March 2020. Investors are watching nervously as Bitcoin and other digital assets continue to slide, raising concerns about potential further market declines.

The past few weeks have been particularly volatile for cryptocurrency markets, with President Trump's introduction of "reciprocal tariffs" adding fuel to an already unstable financial environment. Bitcoin, the leading cryptocurrency by market capitalization, has been hit especially hard, experiencing significant value erosion that echoes the traumatic market collapse witnessed during the early stages of the pandemic.

Market analysts are drawing uncomfortable similarities between the current market conditions and the unprecedented downturn of March 2020, when cryptocurrencies suffered massive losses. The ongoing uncertainty suggests that digital asset investors may need to brace themselves for continued market turbulence in the coming weeks.

As global economic tensions persist, the cryptocurrency market remains on edge, with many wondering whether this current correction represents a temporary setback or the beginning of a more prolonged market adjustment.