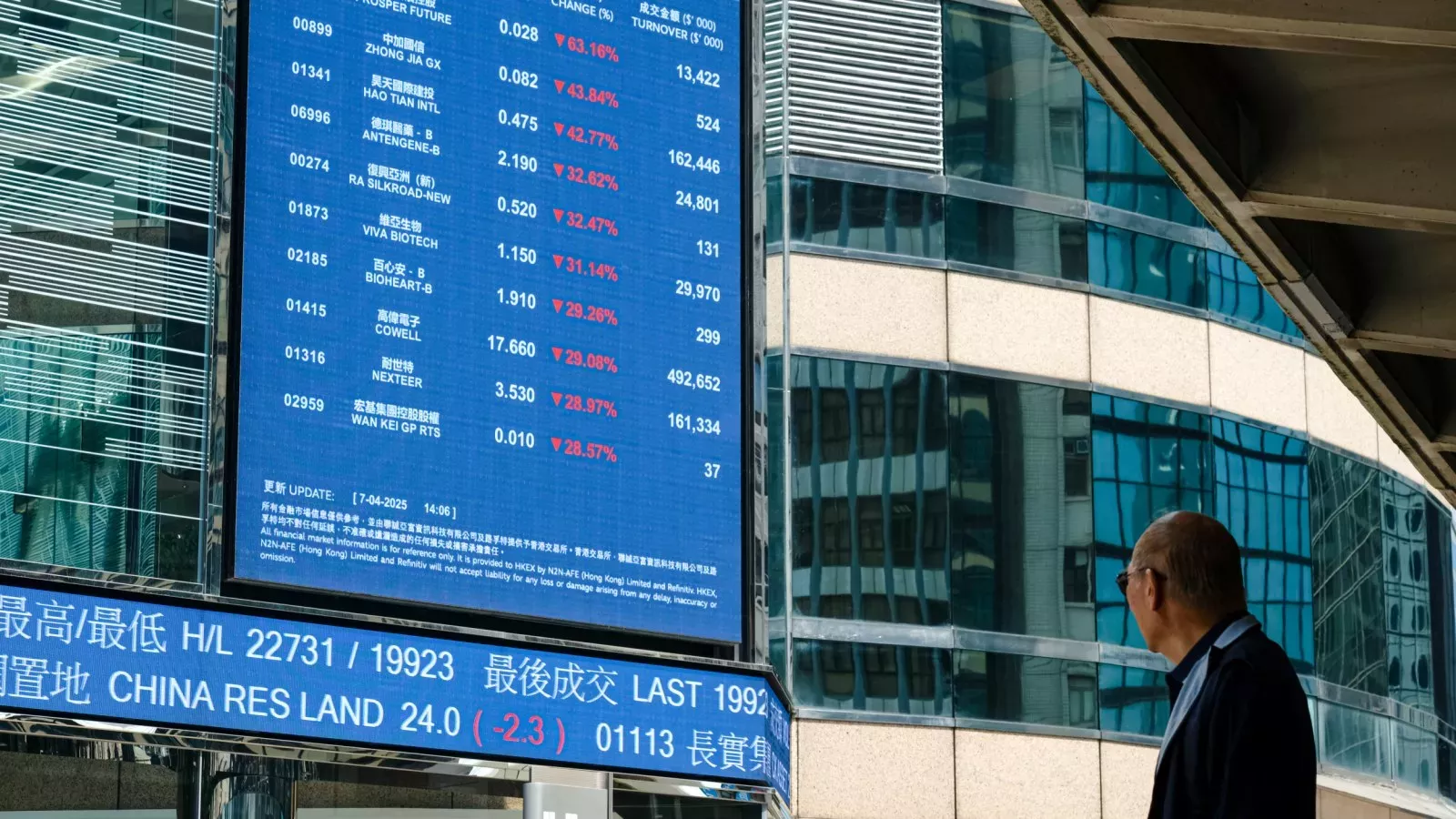

Wheels of Deception: Local Shipping Mogul Caught in Massive $6.4 Million Tax Evasion Scheme

In a significant legal development, a Michigan businessman has admitted to serious tax violations related to his international vehicle shipping enterprise. The individual pleaded guilty to two critical financial offenses: submitting a fraudulent tax return and deliberately avoiding tax payments on cash wages distributed to his employees.

The case highlights the ongoing efforts of tax authorities to crack down on businesses that attempt to circumvent tax regulations. By concealing income and misrepresenting financial records, the defendant not only violated federal tax laws but also undermined the integrity of legitimate business practices.

This guilty plea serves as a stark reminder that tax evasion carries serious legal consequences, potentially resulting in substantial financial penalties and potential criminal prosecution. The case underscores the importance of transparency and compliance in business financial reporting.