Crypto Victory: Cruz Champions Landmark Legislation in Regulatory Breakthrough

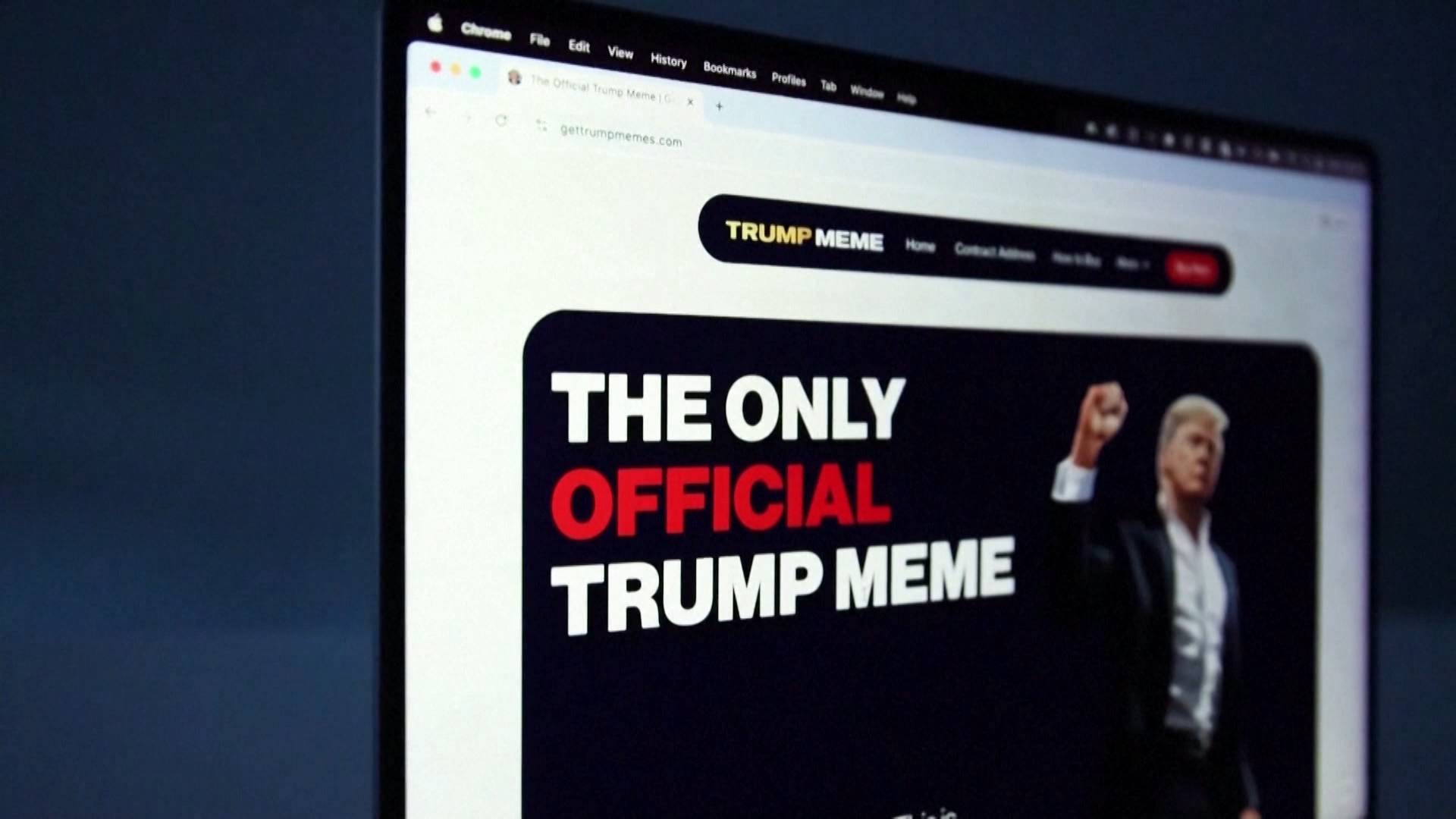

In a significant victory for cryptocurrency developers and the digital finance industry, U.S. Senator Ted Cruz of Texas celebrated a pivotal moment as President Trump signed a Congressional Review Act (CRA) resolution targeting Decentralized Finance (DeFi) regulations.

The resolution effectively blocks a controversial Internal Revenue Service (IRS) rule that would have broadly classified certain cryptocurrency developers as "brokers" for tax reporting purposes. By overturning this rule, Cruz and supporters of the digital finance sector have pushed back against what they viewed as overly restrictive government oversight.

The move signals a critical win for tech innovators and blockchain entrepreneurs who argued that the original IRS proposal could stifle technological innovation and impose unreasonable reporting burdens on software developers in the rapidly evolving cryptocurrency landscape.

Senator Cruz has been a vocal advocate for protecting technological innovation and limiting government intervention in the digital finance space. This successful resolution represents a significant step in preserving the flexibility and potential of decentralized financial technologies.

The CRA's passage underscores the ongoing dialogue between regulatory bodies and the dynamic world of digital currencies, highlighting the complex challenges of adapting traditional financial frameworks to emerging technological ecosystems.