Crypto Markets Brace: Trump's Tariff Tremors Shake Digital Asset Landscape

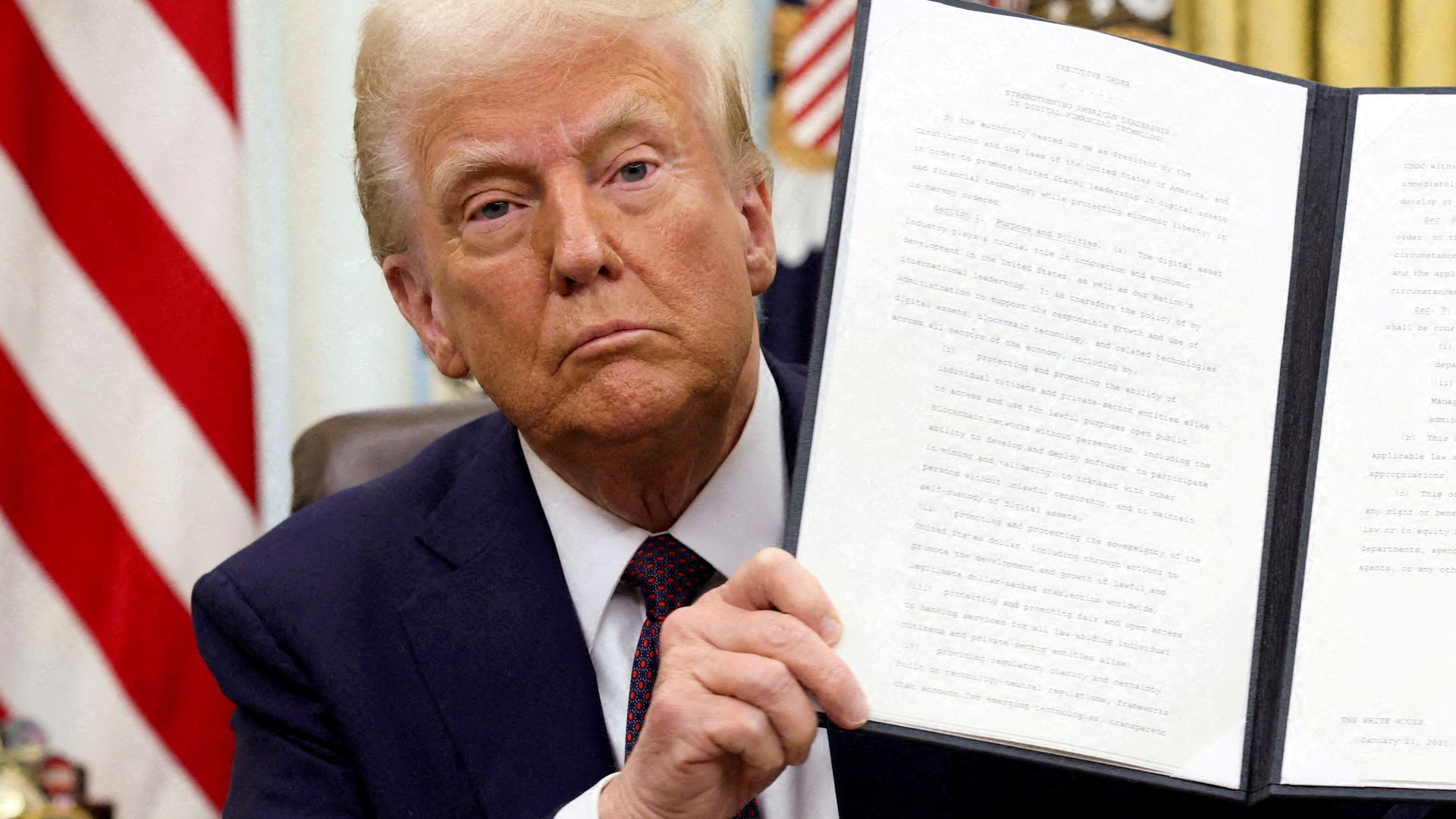

Trump's Tariff Decision Sparks Cryptocurrency Market Volatility

The cryptocurrency landscape is experiencing significant turbulence following President Trump's latest economic maneuver. In a decisive move, the administration has eliminated any temporary tariff exemptions for electronics, sending shockwaves through financial markets and catching cryptocurrency traders off guard.

Market analysts are closely monitoring the potential ripple effects of this announcement. The sudden policy shift suggests increased uncertainty, which traditionally creates both challenges and opportunities for digital asset investors. Cryptocurrency traders are advised to remain vigilant and adaptable in the face of these rapidly changing economic conditions.

The intersection of trade policy and digital currencies continues to demonstrate how geopolitical decisions can instantaneously impact market sentiment and trading strategies. Investors should prepare for potential market volatility and consider diversifying their investment portfolios to mitigate potential risks.

As the situation develops, staying informed and maintaining a strategic approach will be crucial for navigating the complex landscape of cryptocurrency investments.