Crypto Chaos: Binance Bounces Back After Cloud Catastrophe Halts Transactions

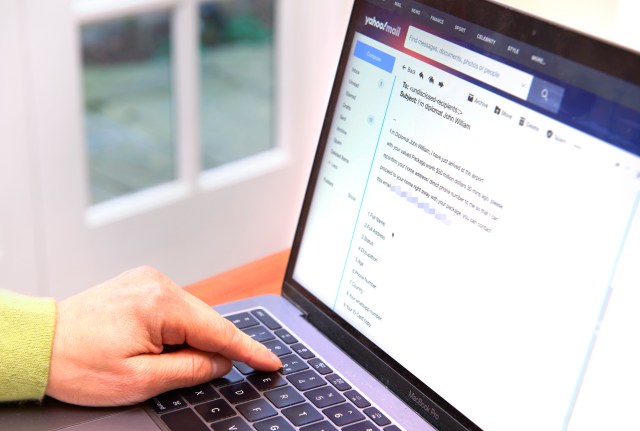

In a sudden turn of events, two major cryptocurrency exchanges, Binance and KuCoin, unexpectedly halted withdrawal services early Tuesday morning on April 15th. The disruption sent ripples through the digital currency market, leaving traders and investors momentarily uncertain.

According to CoinDesk's reporting, the suspension arose from an unspecified technical issue that prompted both platforms to take immediate action. While the exact nature of the problem remains unclear, such temporary withdrawals are not uncommon in the fast-paced and complex world of cryptocurrency trading.

Cryptocurrency enthusiasts and market watchers are closely monitoring the situation, awaiting further details and updates from the exchanges. The brief interruption highlights the ongoing challenges and technical complexities inherent in digital asset platforms.

Users of Binance and KuCoin are advised to stay informed through official communication channels and exercise patience as the exchanges work to resolve the underlying technical concerns.