Mountain Landlords: Navigating the High-Stakes Real Estate Game in Santa Cruz

In the laid-back San Lorenzo Valley, an unexpected social paradox exists: discussing cannabis consumption comes more naturally than sharing my decade-long success as a property investor. Yet, my story is far from unique. Like many individuals with physical disabilities, I rely on passive income streams to support my caregiving needs.

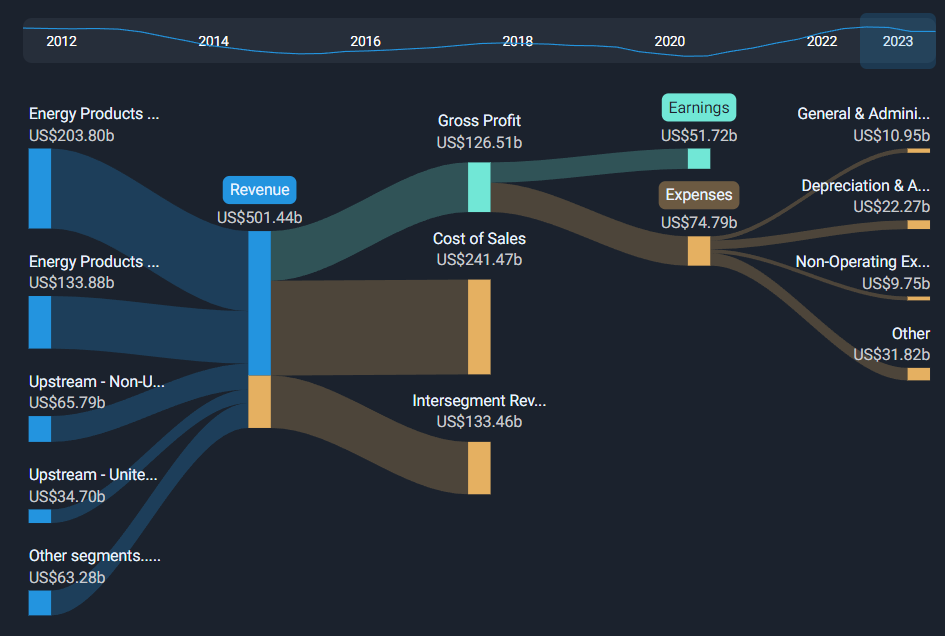

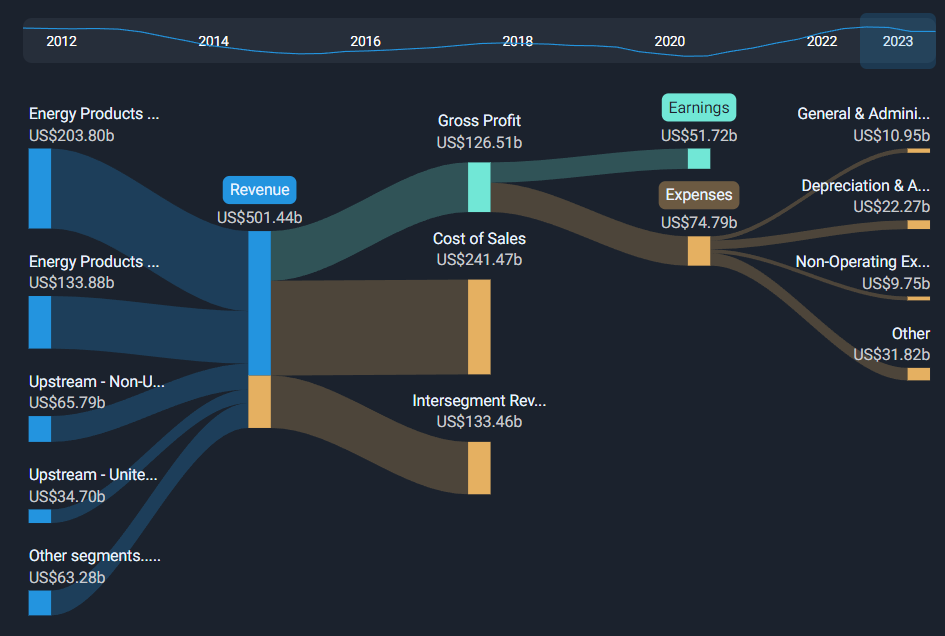

The world of real estate investment is a strategic chess match, with savvy landlords playing what I call "The Big Game" - a calculated pursuit of capital appreciation through leveraged investments. Imagine purchasing a $1 million property with the nuanced understanding that each strategic decision could potentially multiply your financial returns.

For paraplegic entrepreneurs like myself, rental properties aren't just investments; they're lifelines of financial independence and stability. We transform challenges into opportunities, using real estate as a powerful tool for economic empowerment and personal resilience.