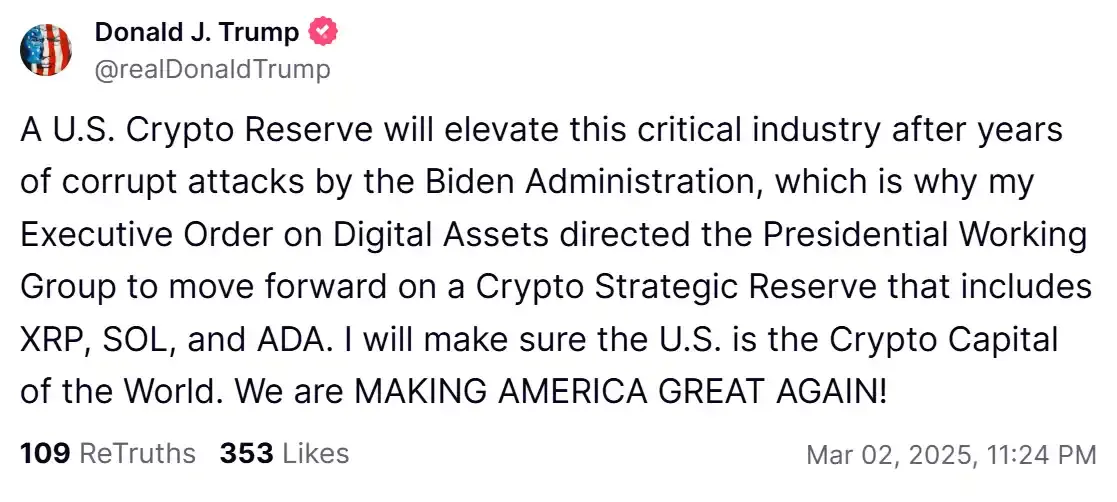

Crypto Titan Unleashes Scathing Critique of Trump Organization's Business Practices

Cryptocurrency Investor Justin Sun Challenges Unexpected Asset Freeze

Prominent blockchain entrepreneur Justin Sun has raised concerns after discovering that his holdings in World Liberty Financial's cryptocurrency have been unexpectedly immobilized. In a recent statement, Sun described the asset freeze as "unreasonably" implemented, suggesting potential irregularities in the financial management of the cryptocurrency platform.

The sudden restriction of Sun's digital assets has sparked speculation within the crypto community about the underlying reasons for the freeze. As a high-profile investor with significant influence in the blockchain ecosystem, Sun's public declaration is likely to draw increased scrutiny to World Liberty Financial's operational practices.

While specific details remain limited, the incident highlights the ongoing challenges and uncertainties that can arise in the rapidly evolving cryptocurrency landscape. Investors and market observers are closely monitoring the situation to understand the full context of this unexpected asset restriction.