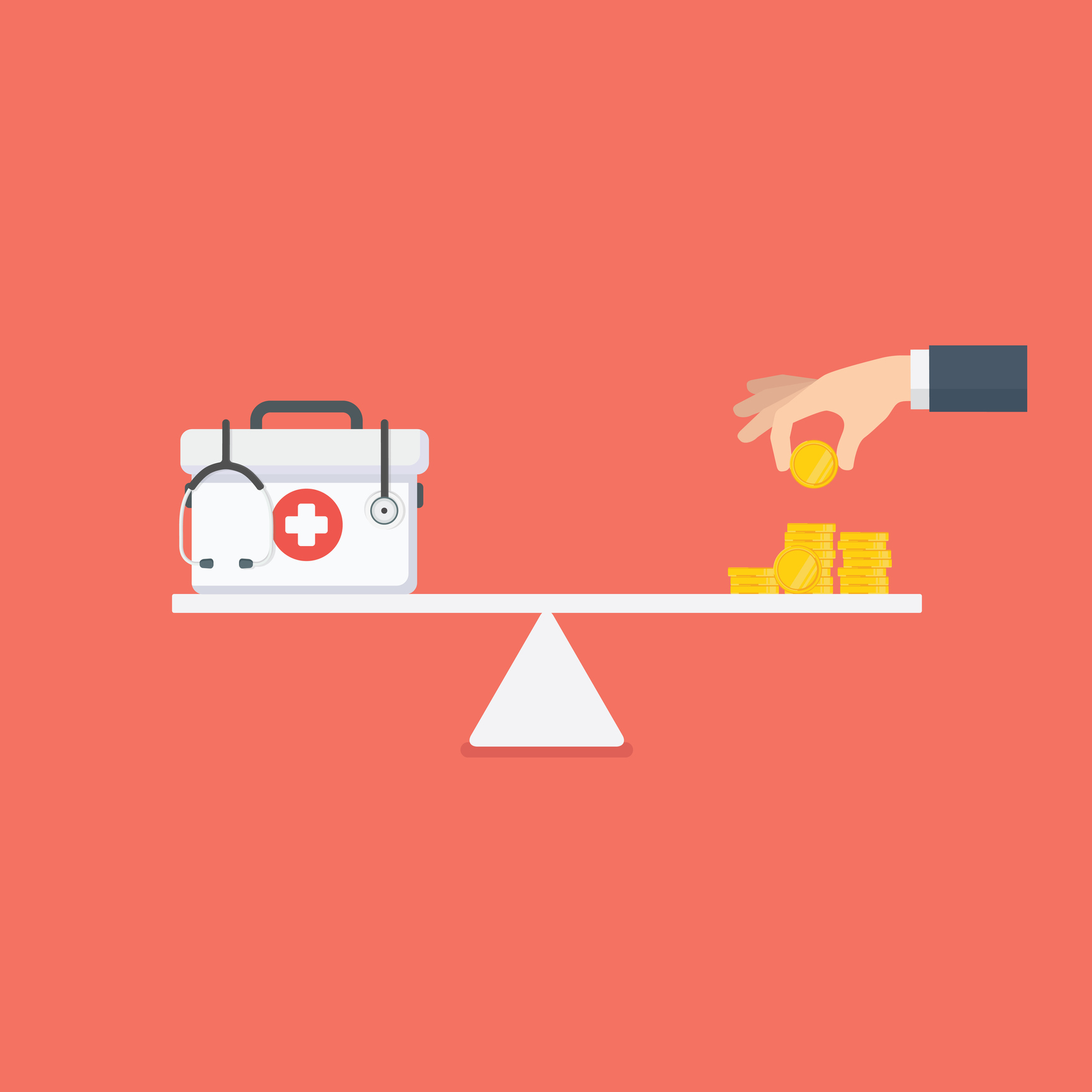

Health Insurance Premiums Set to Skyrocket: Employers Brace for Unprecedented Cost Surge

Brace Yourself: Workplace Health Insurance Premiums on the Rise

If you're among the millions of Americans who rely on employer-sponsored health insurance, get ready for a potential pinch in your wallet. Recent trends suggest that monthly health plan costs are set to climb, potentially impacting your take-home pay and household budget.

Experts predict that workers could see a noticeable increase in their health insurance premiums in the coming year. This means the amount deducted from your paycheck for health coverage might be higher than in previous years, adding another layer of financial pressure for many working professionals.

The rising costs are driven by multiple factors, including increasing healthcare expenses, medical technology advancements, and ongoing economic challenges. While employers typically absorb a significant portion of health insurance costs, employees are likely to feel the impact through slightly higher monthly contributions.

For many workers, this potential premium increase comes at a challenging time, when inflation and living expenses are already stretching household budgets. It's a good idea to review your current health plan, explore potential alternatives, and budget accordingly to manage these anticipated changes.