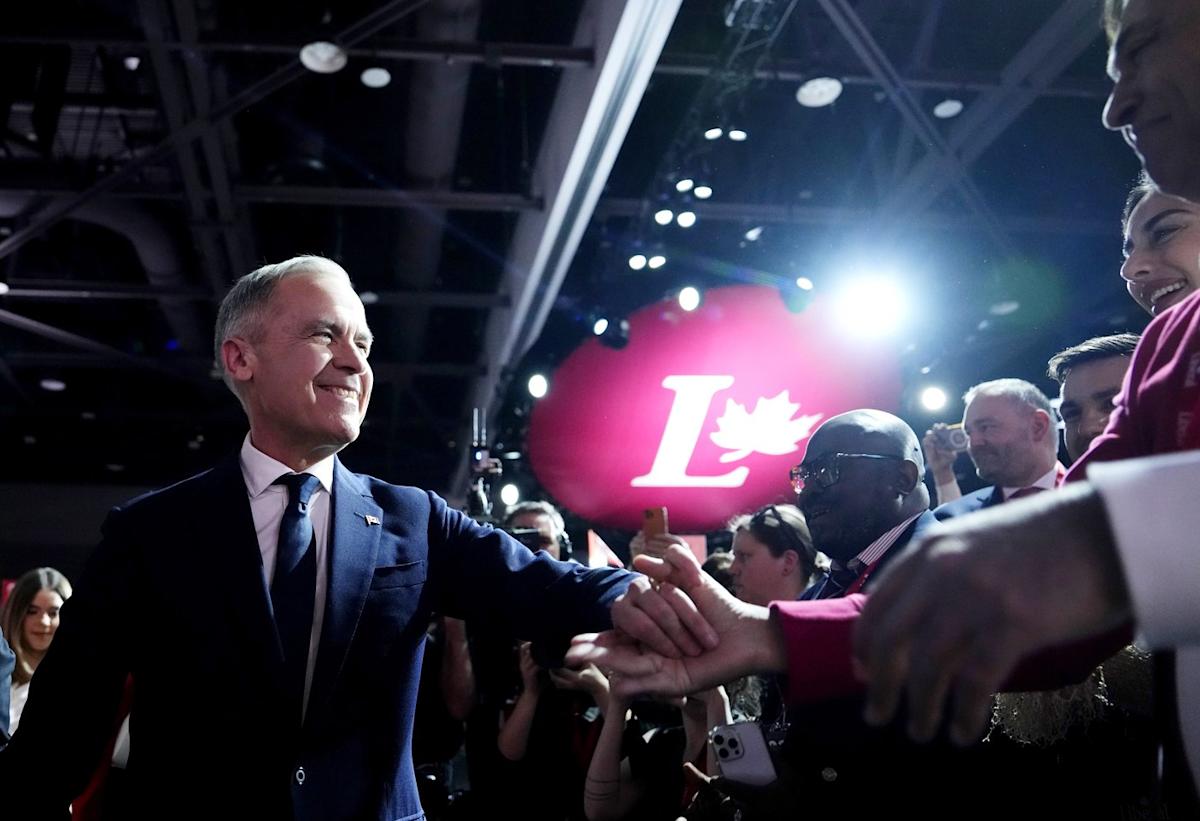

Early Retirement Dream or Financial Fantasy? Inside Tom and Pat's Bold $200K Lifestyle Gamble

Navigating Retirement Savings: A Strategic Approach to Financial Freedom

Tom and his partner are at a critical crossroads in their financial journey, seeking expert guidance on optimizing their retirement savings strategy. Their primary concerns revolve around two key questions: how to efficiently withdraw funds from Tom's holding company while minimizing tax implications, and whether their current savings will sufficiently support their retirement lifestyle.

The couple understands that strategic financial planning is crucial during this pivotal transition. By consulting with financial professionals, they aim to develop a comprehensive approach that maximizes their hard-earned savings and ensures a comfortable, stress-free retirement.

Their proactive approach demonstrates a thoughtful commitment to financial security. By carefully examining their withdrawal options and assessing their current savings, they're taking important steps to create a robust retirement plan that aligns with their long-term financial goals and personal aspirations.

The path to a successful retirement requires careful navigation, and Tom and his partner are wisely seeking the expertise needed to make informed decisions about their financial future.