Crypto Paychecks: How Bitcoin is Revolutionizing Employee Compensation

Bitcoin Holdings: Revolutionizing Payroll in the Digital Age

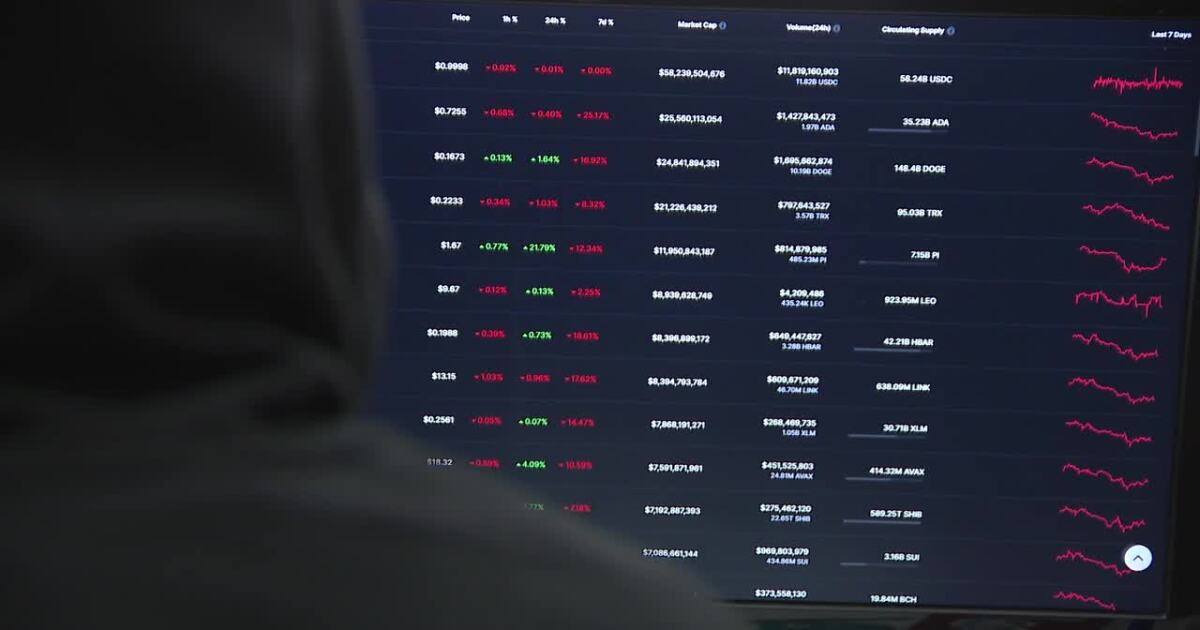

In an era of rapid digital transformation, companies are increasingly turning to cryptocurrency as a innovative solution for employee compensation. Corporate Bitcoin holdings are reshaping traditional payroll strategies, offering a cutting-edge approach to financial management that balances technological innovation with regulatory compliance.

As businesses explore crypto payments, they're discovering a new frontier of employee compensation that goes beyond conventional banking systems. Bitcoin's growing mainstream acceptance has prompted forward-thinking organizations to integrate digital currencies into their financial ecosystems, creating flexible and potentially more attractive compensation packages.

The key challenges of implementing crypto payroll include managing market volatility and navigating complex regulatory landscapes. Smart companies are developing sophisticated strategies to mitigate risks, using advanced hedging techniques and real-time conversion mechanisms to protect both employer and employee financial interests.

From tech startups to established multinational corporations, the trend of cryptocurrency-based compensation is gaining momentum. Employees benefit from faster transactions, reduced international transfer fees, and the potential for asset appreciation, while employers gain a competitive edge in talent attraction and retention.

As the financial world continues to evolve, Bitcoin and other cryptocurrencies are no longer just speculative assets but emerging tools for reimagining workplace compensation. The future of payroll is digital, decentralized, and increasingly dynamic.