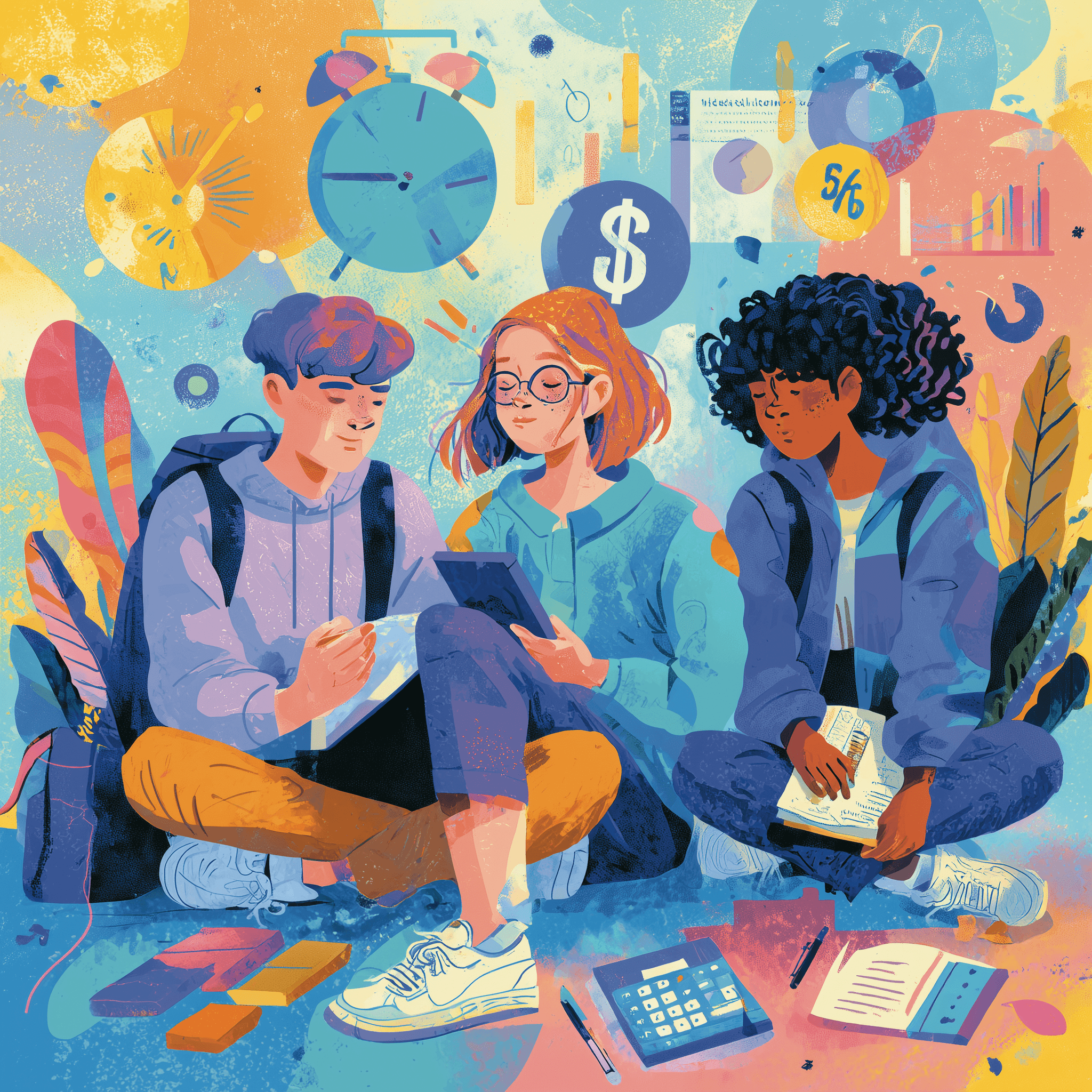

Money Smarts: Why Your Teen's Financial Future Depends on What They Learn Today

While Concord-Carlisle High School stands as a beacon of academic excellence, there's a critical gap in its educational approach that demands immediate attention. Our students are receiving top-tier academic instruction, but they're graduating without essential life skills in financial literacy.

In today's complex economic landscape, understanding personal finance is no longer a luxury—it's a necessity. Our high-performing school district has an opportunity to transform students' futures by integrating comprehensive financial education into the curriculum. Imagine empowering young adults with the knowledge to budget effectively, understand credit, make informed investment decisions, and navigate the financial challenges of adulthood.

By proactively addressing this educational blind spot, we can ensure that our students are not just academically prepared, but financially savvy. The goal isn't just about creating successful students, but about cultivating financially resilient citizens who can confidently manage their economic futures.

It's time for Concord-Carlisle to take the lead in holistic education—bridging academic excellence with real-world financial skills that will serve our students for a lifetime.