Financial Lifeline: Express Loans Spark Small Business Revival in Manistee County

Empowering Local Businesses: Venture North Launches Affordable Express Loan Program

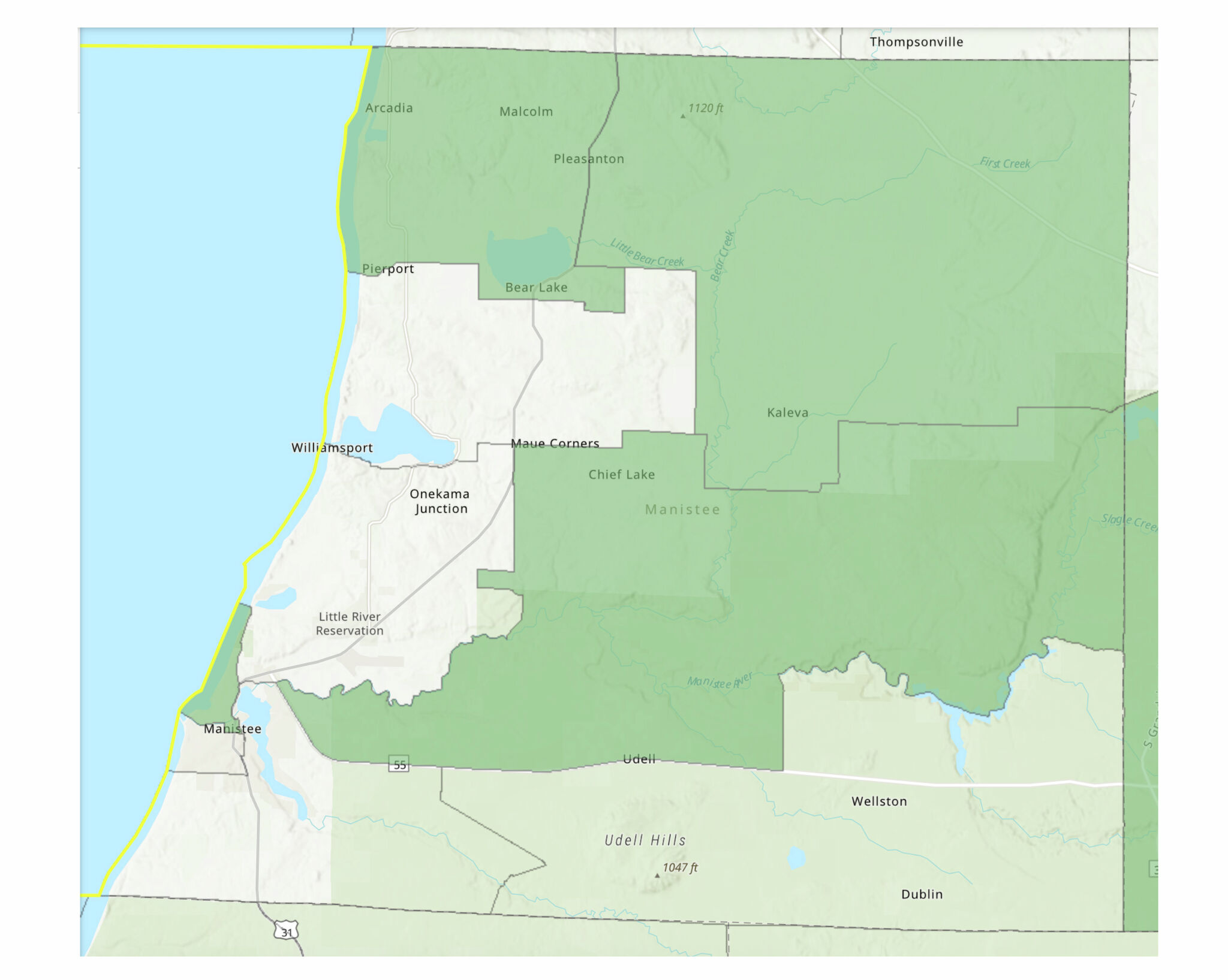

Small businesses in Manistee County now have an exciting opportunity to fuel their growth with Venture North's innovative lending initiative. The organization is offering low-interest express loans ranging from $5,000 to $25,000, specifically designed to support local entrepreneurs in targeted areas and those meeting specific income qualifications.

This strategic financial program aims to provide quick and accessible funding for small businesses that might struggle to secure traditional bank loans. By offering competitive interest rates and flexible terms, Venture North is committed to fostering economic development and supporting the vibrant business community in Manistee County.

Eligible businesses can leverage these express loans to invest in expansion, purchase equipment, manage cash flow, or seize new market opportunities. The streamlined application process ensures that local entrepreneurs can access the financial support they need with minimal bureaucratic hurdles.

Local business owners are encouraged to explore this opportunity and learn more about how Venture North's express loan program can help transform their entrepreneurial dreams into reality.