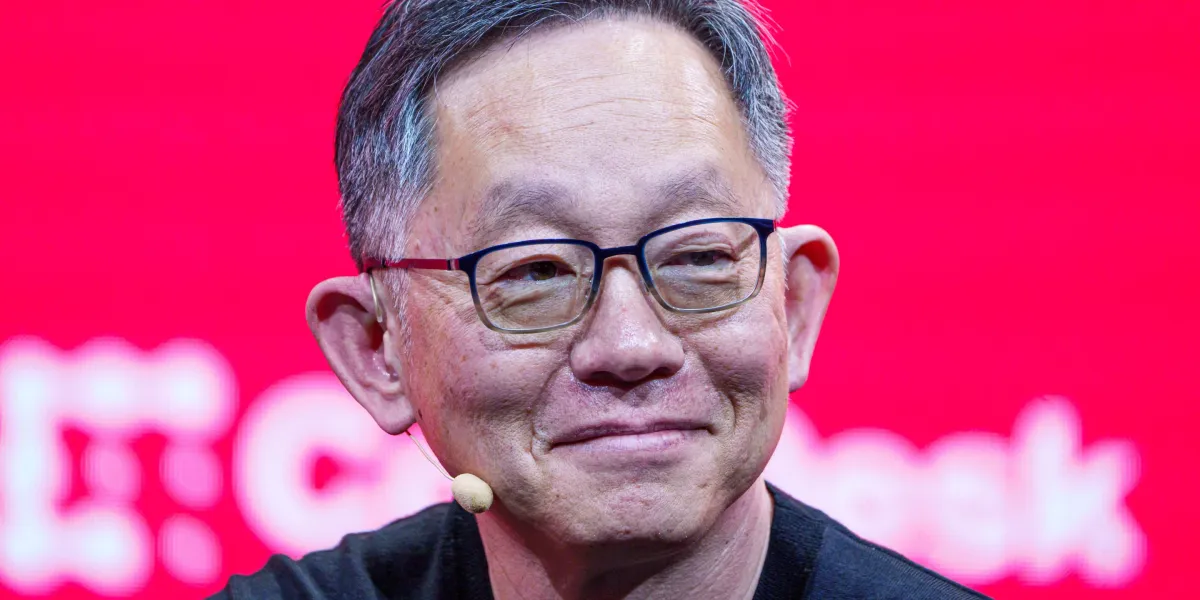

Crypto Powerhouse HashKey Unveils Massive $500M Digital Treasury Fund, Signaling New Era in Blockchain Investment

HashKey Group, Hong Kong's premier licensed cryptocurrency exchange, is set to make waves in the digital asset investment landscape. The company announced its groundbreaking launch of a Digital Asset Treasury (DAT) fund, targeting an impressive initial capital raise of $500 million.

This strategic move signals HashKey Group's commitment to expanding its footprint in the rapidly evolving digital asset ecosystem. By introducing this substantial fund, the company aims to provide institutional and sophisticated investors with a robust investment vehicle tailored to the dynamic world of digital assets.

The launch comes at a pivotal moment in the cryptocurrency market, demonstrating HashKey Group's confidence and vision in the potential of digital assets as a legitimate and promising investment class. With its significant target size, the fund is poised to attract serious investors looking for sophisticated and professionally managed crypto investment opportunities.