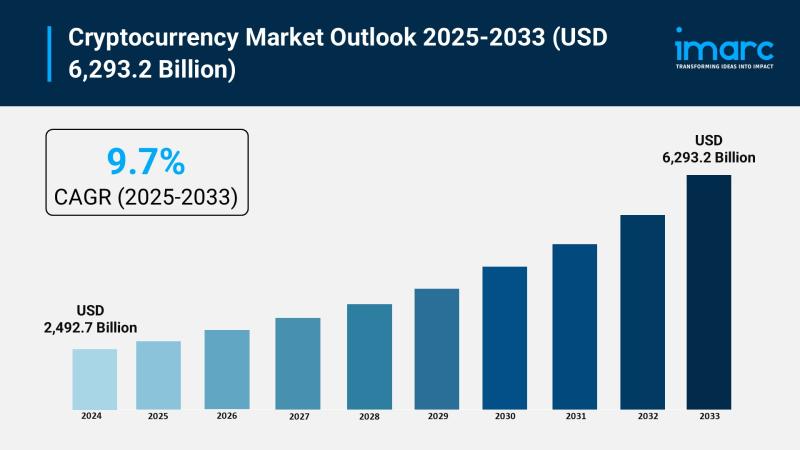

Crypto Revolution: Global Market Poised to Explode to $6.3 Trillion by 2033

Cryptocurrency Market: A Landscape of Unprecedented Growth and Innovation

The cryptocurrency ecosystem is currently experiencing a transformative phase, characterized by dynamic expansion and increasing mainstream acceptance. Recent market trends reveal a compelling narrative of growth driven by three key catalysts: enhanced regulatory frameworks, robust institutional engagement, and the rapid evolution of decentralized financial technologies.

Key Market Drivers

- Regulatory Clarity: Governments and financial regulators worldwide are developing more transparent guidelines, instilling greater confidence among investors and market participants.

- Institutional Adoption: Major corporations and financial institutions are increasingly integrating cryptocurrency and blockchain technologies into their strategic frameworks, signaling a significant shift in perception.

- Technological Innovation: The surge in Stablecoins and Decentralized Finance (DeFi) platforms is revolutionizing traditional financial services, offering more accessible and efficient alternatives.

According to the latest research by IMARC Group, the cryptocurrency market is poised for substantial growth, with emerging trends indicating a promising future for digital assets and blockchain technology.