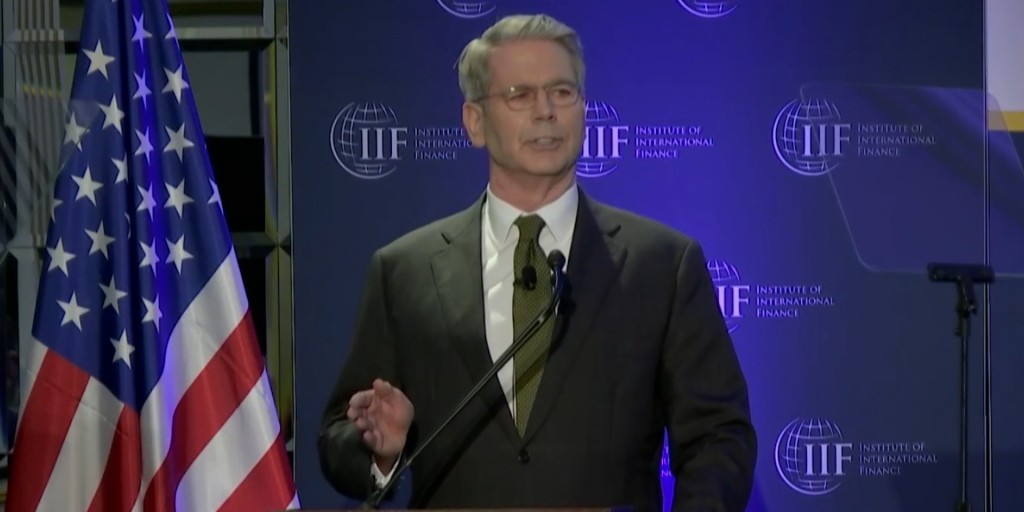

Private Equity Shake-Up: KKR's Finance Chief Predicts Industry Consolidation Wave

In a bold prediction that's sending ripples through the financial world, KKR & Co.'s chief financial officer suggests the private equity landscape is on the cusp of significant transformation. As dealmaking continues to stagnate, the industry is bracing for a wave of consolidation that could dramatically reshape its competitive landscape.

The prolonged slowdown in deal activity is creating unprecedented pressure on private equity firms, forcing them to adapt or risk becoming obsolete. With fewer opportunities and tightening investment conditions, smaller firms may find themselves struggling to survive, potentially leading to mergers, acquisitions, or complete market exits.

This forecast highlights the challenging environment facing private equity, where only the most agile and strategically positioned firms are likely to thrive. As competition intensifies and market dynamics shift, the industry stands at a critical juncture that could redefine its future structure and operational strategies.