Crypto Predator's Rampage Reveals Hidden Shield: Campbell County's Game-Changing Digital Defense

In a dramatic turn of events, local law enforcement recently stepped in to rescue a victim from a sophisticated cryptocurrency scam, successfully helping her recover $23,000 and exposing the intricate tactics used by modern digital fraudsters.

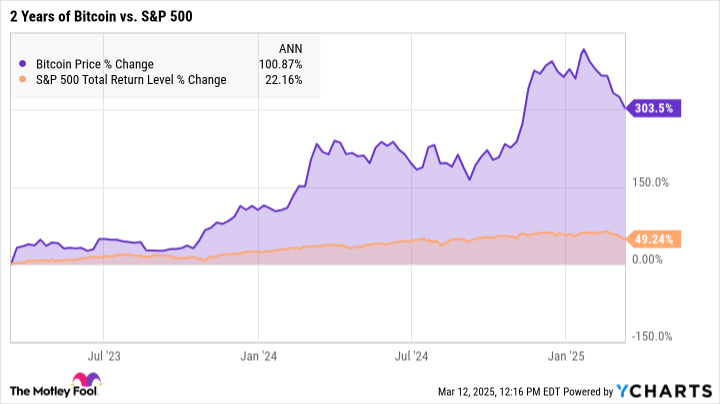

The incident serves as a stark reminder of the increasingly complex ways criminals exploit unsuspecting individuals through online financial schemes. Scammers are becoming more cunning, using advanced techniques to manipulate and deceive potential targets, particularly in the rapidly evolving world of digital currencies.

This case highlights the critical importance of vigilance and the essential role of law enforcement in protecting citizens from increasingly sophisticated financial fraud. The police department's swift intervention not only recovered the victim's funds but also demonstrated the growing expertise of authorities in combating digital crime.

Victims of such scams often feel isolated and helpless, making this successful recovery a beacon of hope for others who might find themselves targeted by similar fraudulent activities. The incident underscores the need for public awareness and proactive measures to prevent falling prey to these elaborate financial traps.