Shock Wave in Jakarta: Finance Minister's Ouster Sparks Market Panic and Rupiah Freefall

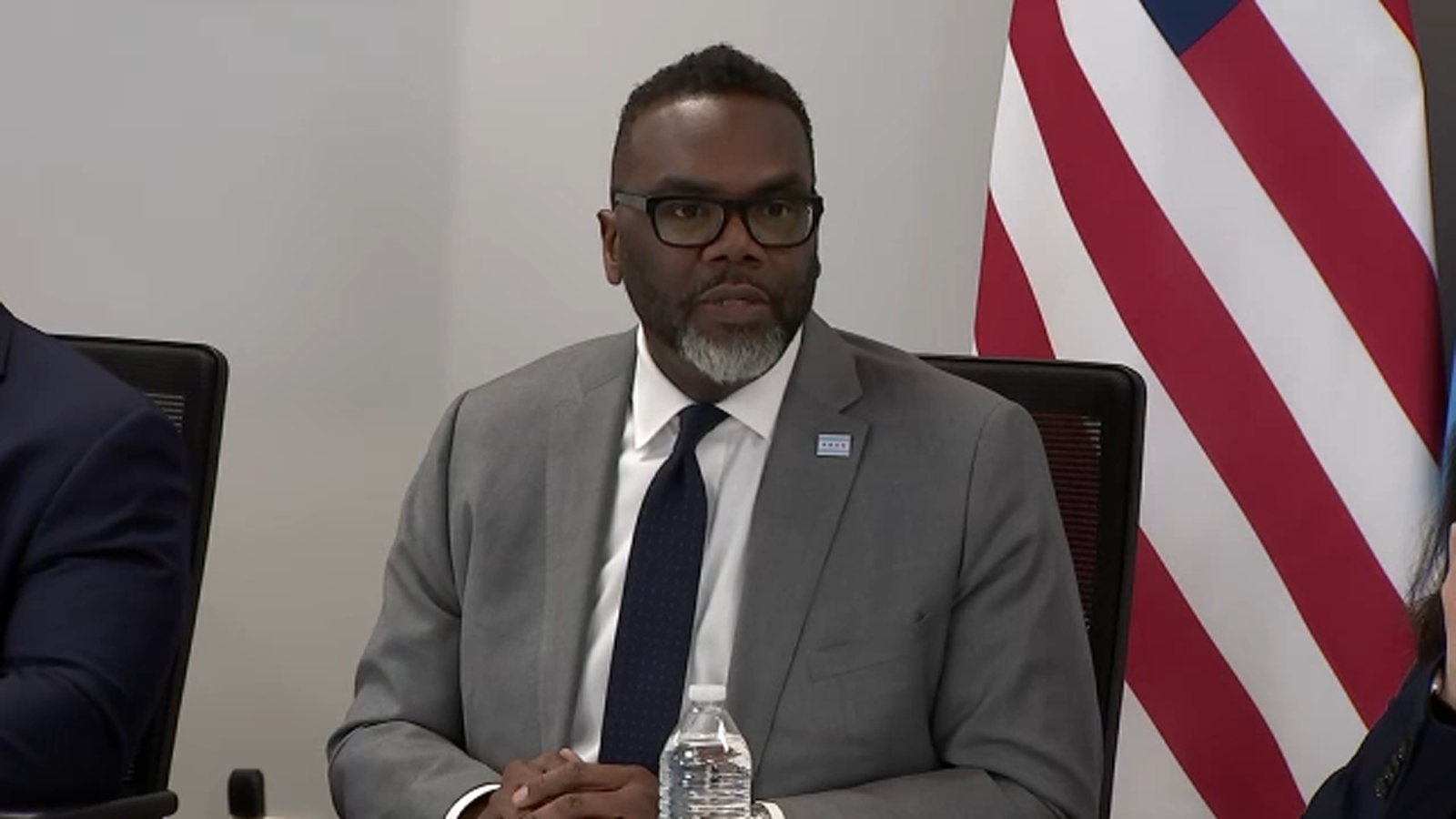

The sudden departure of Sri Mulyani Indrawati from her role as Indonesia's finance minister has sent shockwaves through financial markets, raising serious concerns about the country's economic stability. Widely respected for her fiscal discipline and economic expertise, Mulyani's unexpected removal comes at a critical moment for Indonesia's economic trajectory.

Investors are now nervously watching President Prabowo Subianto's administration, worried that populist spending initiatives could potentially undermine the hard-won fiscal credibility carefully built over years. Mulyani, who was known for her pragmatic approach to economic management, had been a key figure in maintaining Indonesia's financial reputation on the global stage.

The abrupt leadership change signals a potential shift in economic policy, with market participants expressing apprehension about the potential erosion of sound fiscal practices. The uncertainty surrounding the ministerial transition has already begun to create ripples of unease among both domestic and international investors, who fear that pragmatic economic management might be sacrificed for short-term political gains.

As Indonesia stands at this economic crossroads, the financial community remains on high alert, closely monitoring how the new leadership will navigate the delicate balance between populist promises and fiscal responsibility.