Digital Gold or Digital Fool? How Cryptocurrency Is Rewriting the Rules of Money

The world of cryptocurrency often evokes the mystical allure of Goethe's timeless drama, Faust. Much like Mephistopheles' seductive promise of infinite wealth through magical paper money, cryptocurrencies tantalize modern investors with visions of financial transformation and boundless potential.

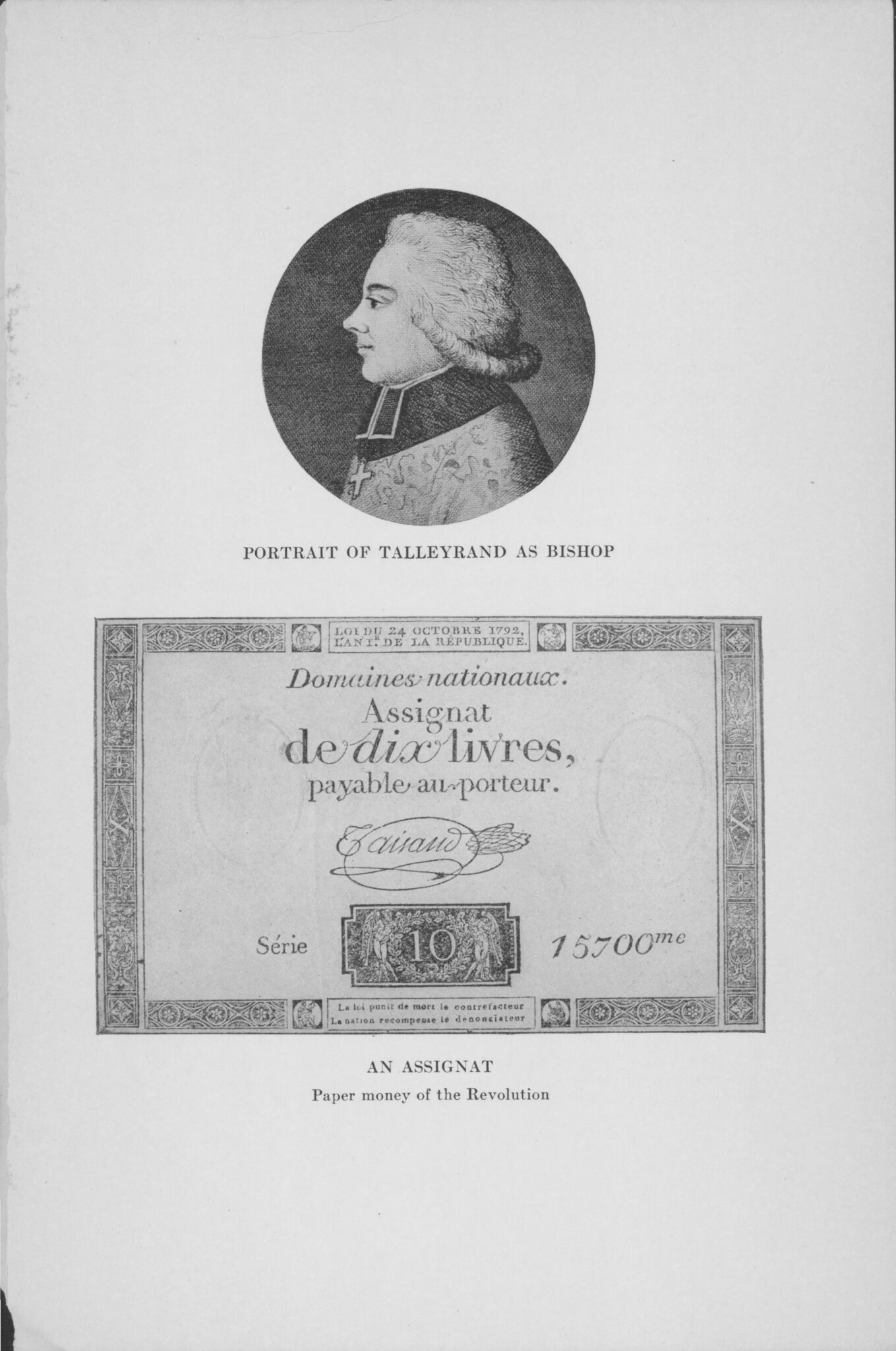

In the play, an emperor is captivated by the revolutionary concept of printing currency—a notion as radical in its time as digital currencies are today. The parallel is striking: both represent a fundamental reimagining of monetary value, challenging traditional financial paradigms and offering a glimpse into a world where wealth can be conjured seemingly out of thin air.

Just as Mephistopheles offered a tempting but potentially dangerous vision of economic possibility, cryptocurrencies present a similar narrative of innovation and risk. They promise liberation from conventional banking systems, yet carry the same underlying tension between revolutionary potential and potential peril.

The cryptocurrency landscape, much like the magical realm of Faust, is a complex dance of hope, speculation, and the eternal human desire to transcend existing economic limitations.