Crypto Cash Trap: Idaho AG Sounds Alarm on ATM Fraud Epidemic

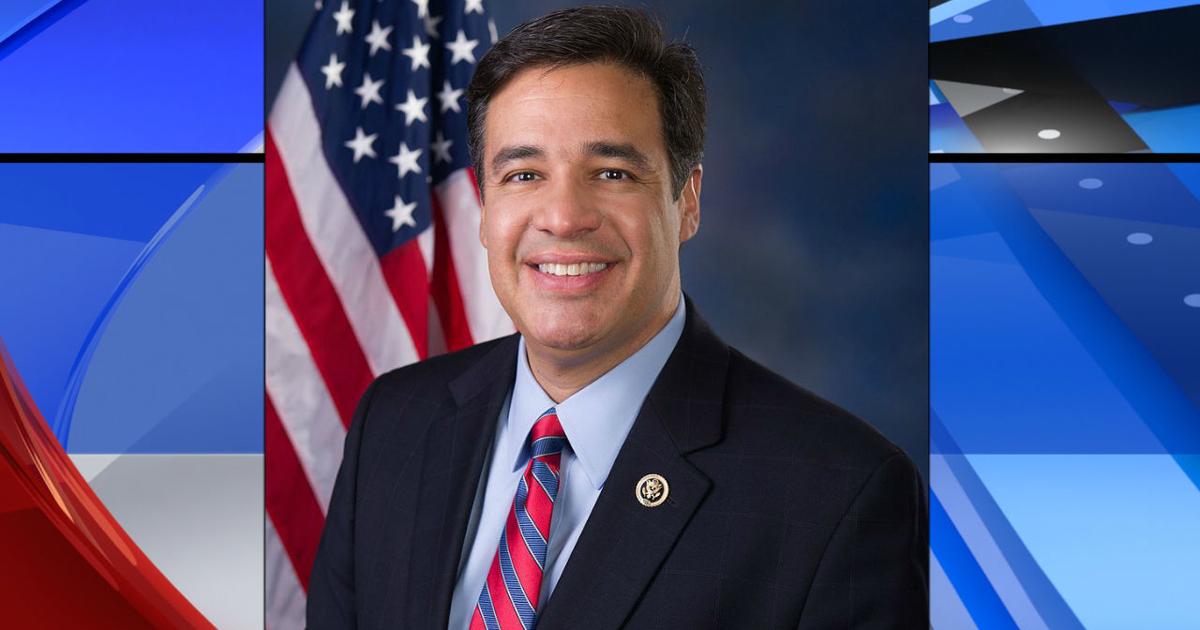

Crypto ATM Scams Targeting Seniors: AG Labrador Sounds the Alarm

In a stark warning to Idaho's vulnerable senior population, Attorney General Raúl Labrador is drawing attention to a growing threat of sophisticated cryptocurrency ATM scams that are preying on unsuspecting older residents.

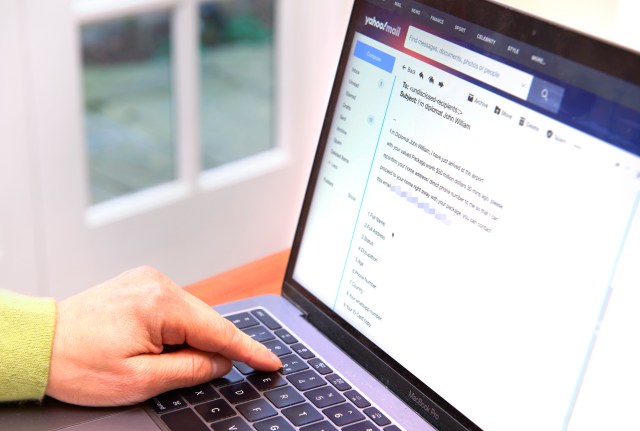

These increasingly complex scams typically begin with deceptive phone calls that appear to be from legitimate tech support services or government agencies. Scammers use manipulative tactics to convince seniors they are facing urgent financial or technical problems that can only be resolved by transferring money through cryptocurrency ATMs.

Criminals are becoming more brazen, using high-pressure techniques and elaborate stories to trick elderly victims into believing they must act immediately. The scammers often guide their targets through the process of purchasing cryptocurrency at local ATMs, effectively draining their life savings.

AG Labrador urges seniors and their families to be vigilant, recommending they:

- Never trust unsolicited phone calls claiming to be from tech support or government agencies

- Verify the identity of anyone requesting financial transactions

- Consult family members or trusted advisors before making any unexpected financial decisions

- Report suspicious calls to local law enforcement

By raising awareness and promoting caution, the Attorney General hopes to protect Idaho's senior citizens from these predatory financial schemes.