Small Business America: The Hidden Heart of Affordable Care Act Insurance

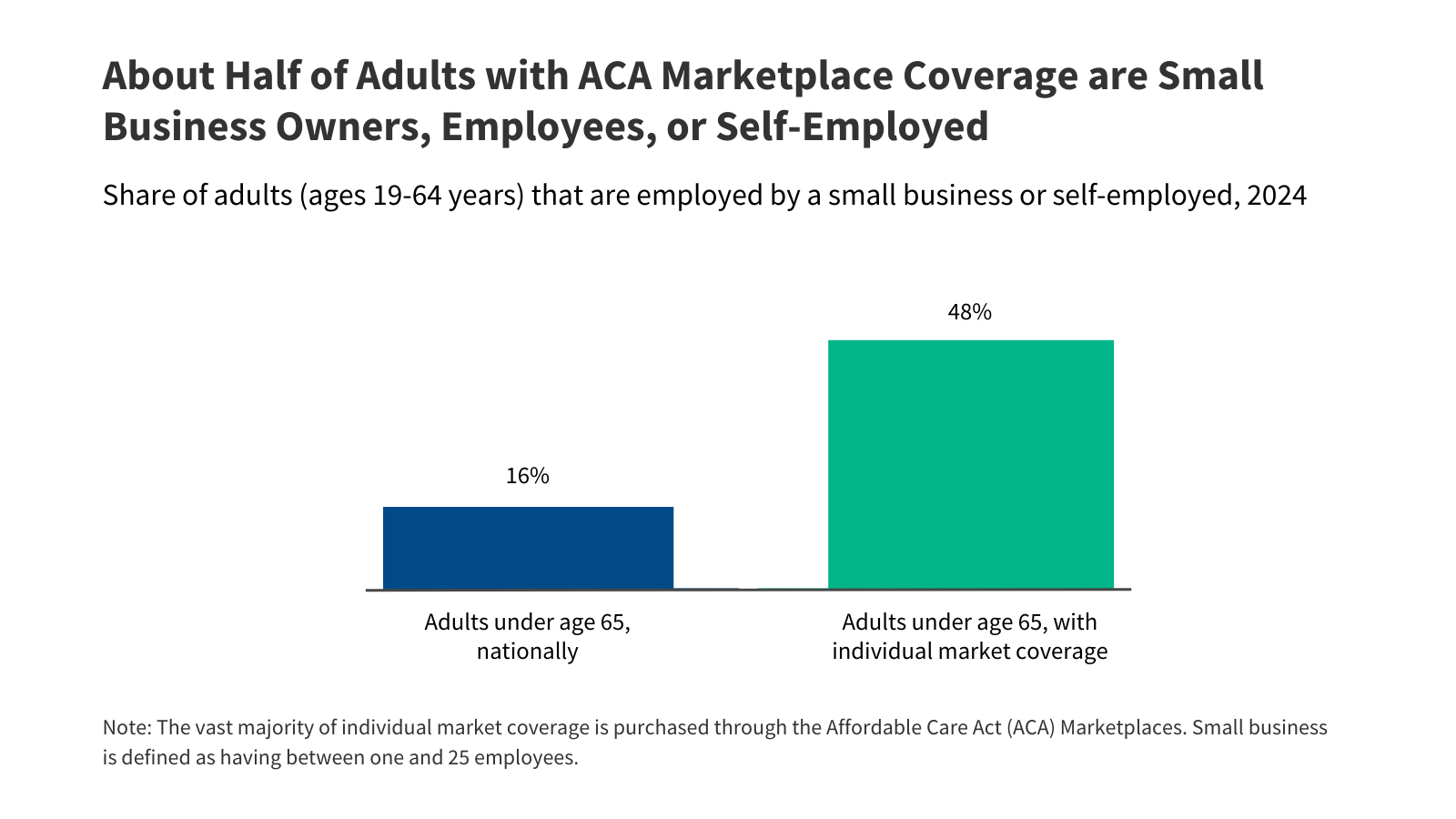

A groundbreaking analysis reveals a striking insight into the healthcare landscape for small business professionals: nearly half of individual market insurance enrollees under 65 are closely tied to small business ecosystems. Specifically, 48% of these individuals are either employed by compact businesses with fewer than 25 employees, working as self-employed entrepreneurs, or operating their own small enterprises.

The majority of these healthcare plans are secured through the Affordable Care Act (ACA) Marketplaces, which makes the potential expiration of enhanced premium tax credits at year's end particularly consequential. Such a change could dramatically reshape the financial burden of healthcare for small business owners and their workers, potentially creating significant economic challenges for this vital segment of the workforce.

This finding underscores the critical importance of understanding and preserving healthcare accessibility for small business professionals, who form a substantial and dynamic part of the American economic landscape. The potential disruption in healthcare affordability could have far-reaching implications for individual workers and the broader small business community.

_Illia_Uriadnikov_Alamy.jpg)