Tiny Loans, Big Dreams: How Microlending Is Transforming Small Business Landscapes

Bridging Financial Opportunities: How Strategic Lending Supports Business Growth

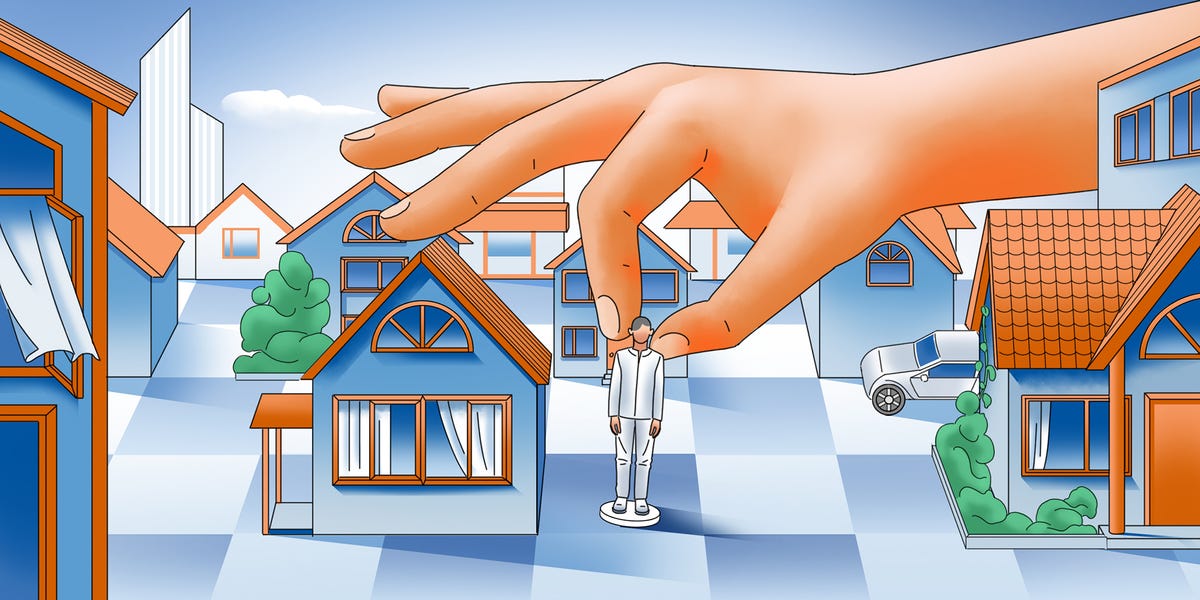

In the dynamic world of entrepreneurship, businesses often face critical moments where access to capital can make or break their operational potential. When traditional financing falls short, specialized organizations emerge as vital lifelines, providing innovative lending solutions that transform potential into reality.

These strategic financial partners understand that every business has unique funding needs. By offering flexible lending options, they help entrepreneurs overcome financial barriers, enabling companies to seize opportunities, expand operations, and drive their vision forward. Whether it's a startup seeking initial funding or an established enterprise looking to scale, targeted financial support can be the catalyst that propels business success.

By filling lending gaps with tailored financial products, these organizations play a crucial role in fostering economic growth and empowering businesses to reach their full potential. Their commitment goes beyond mere transactions—they're strategic allies in turning entrepreneurial dreams into tangible achievements.