Crypto Showdown: Can XRP or World Liberty Financial Become the Next Millionaire-Making Investment?

In today's fast-paced world of marketing and innovation, it's crucial to develop a critical eye and protect yourself from the allure of exaggerated claims and sensationalism. Hype can be a powerful tool that clouds judgment and leads to misguided decisions, whether in business, technology, or personal investments.

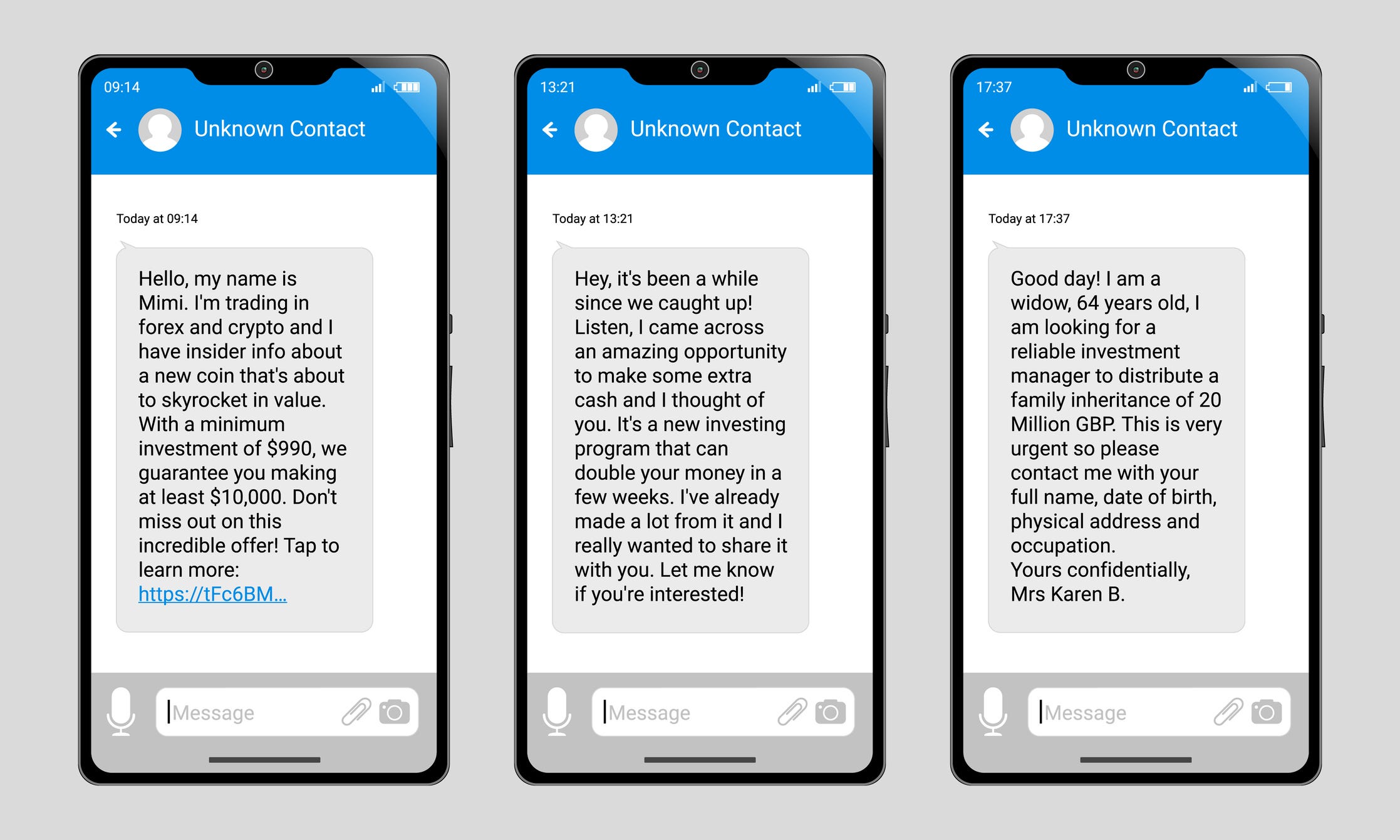

When confronted with bold promises and extraordinary statements, take a step back and approach the information with a healthy dose of skepticism. Look beyond the flashy headlines and carefully examine the substance behind the claims. Ask yourself: Are these promises realistic? What evidence supports these assertions? Are there independent, credible sources that can verify the information?

Developing a discerning mindset means learning to separate genuine potential from mere marketing noise. Research thoroughly, seek multiple perspectives, and don't be swayed by emotional appeals or high-pressure tactics. Remember, true value lies in substance, not in the volume of promotional rhetoric.

By maintaining a balanced and analytical approach, you can navigate through the sea of hype and make more informed, rational choices that align with your goals and best interests.