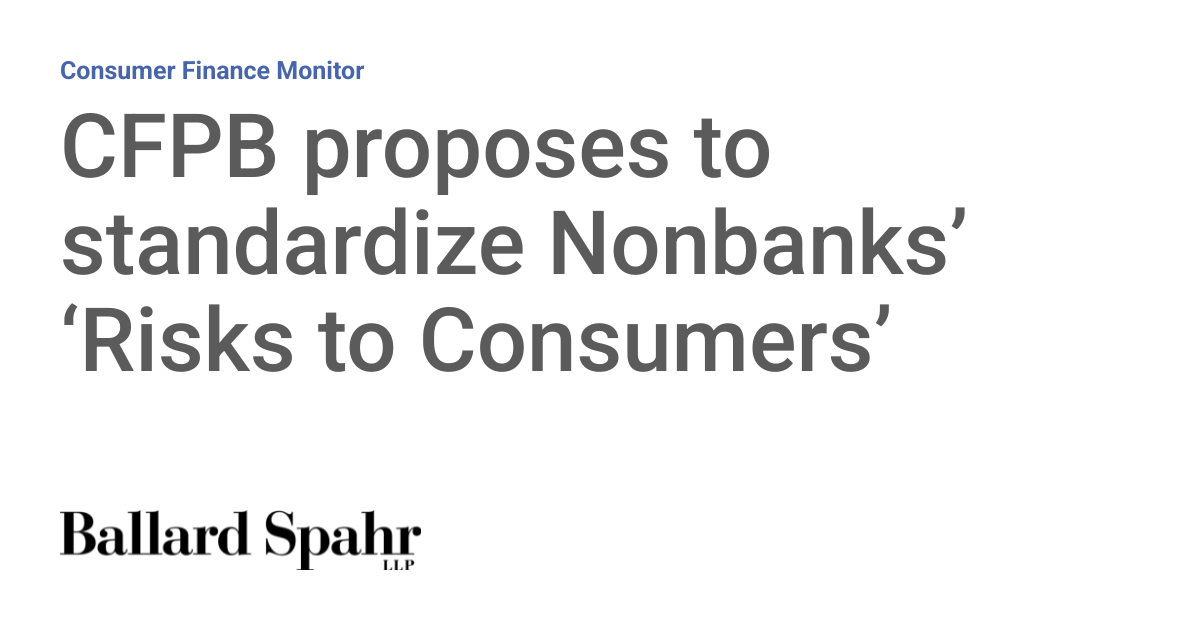

Consumer Watchdog Unveils Bold Plan to Shield Customers from Nonbank Financial Dangers

The Consumer Financial Protection Bureau (CFPB) is taking a bold step to enhance consumer protection by introducing a groundbreaking rule that aims to standardize how nonbank financial institutions are evaluated for potential risks to consumers. This innovative approach could significantly reshape the landscape of financial oversight, potentially reducing the number of nonbank entities operating in the market.

The proposed rule represents a critical effort to create a more transparent and consistent framework for assessing the potential dangers posed by nontraditional financial service providers. By establishing clear, uniform criteria, the CFPB seeks to provide greater clarity and accountability in the financial sector, ultimately protecting consumers from potential predatory practices or risky financial products.

Financial experts suggest this move could have far-reaching implications, potentially forcing many nonbank institutions to either dramatically improve their consumer protection measures or face increased scrutiny and potential limitations on their operations. The rule underscores the CFPB's commitment to maintaining a safe and fair financial environment for consumers across the United States.