Crypto Meets Politics: How Trump's Strategic Reserve Could Spark Rezolve AI's Investment Boom

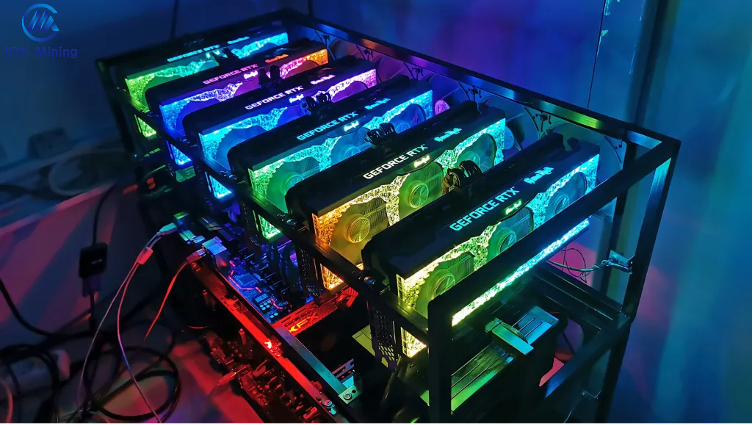

In a groundbreaking move that underscores the growing intersection of blockchain technology and strategic financial planning, Rezolve is positioning itself at the forefront of digital asset innovation. The company has strategically leveraged its collaboration with Tether and its robust Bitcoin treasury, which has been further validated by recent developments surrounding cryptocurrency reserves.

Former President Donald Trump's announcement regarding XRP, Solana, and Cardano as potential strategic reserves has sent ripples through the blockchain ecosystem, directly aligning with Rezolve's forward-thinking approach. This endorsement not only validates the company's blockchain strategy but also highlights the increasing mainstream acceptance of digital assets as legitimate financial instruments.

Rezolve's proactive stance in maintaining a diverse cryptocurrency portfolio, anchored by its strong Bitcoin holdings and Tether partnership, demonstrates a sophisticated understanding of the evolving digital finance landscape. By anticipating and adapting to emerging trends, the company is establishing itself as a visionary player in the blockchain and cryptocurrency space.

The recent developments suggest a transformative period for digital assets, with institutional recognition growing and traditional financial boundaries continuing to blur. Rezolve stands poised to capitalize on these shifts, leveraging its strategic positioning and innovative approach to blockchain technology.