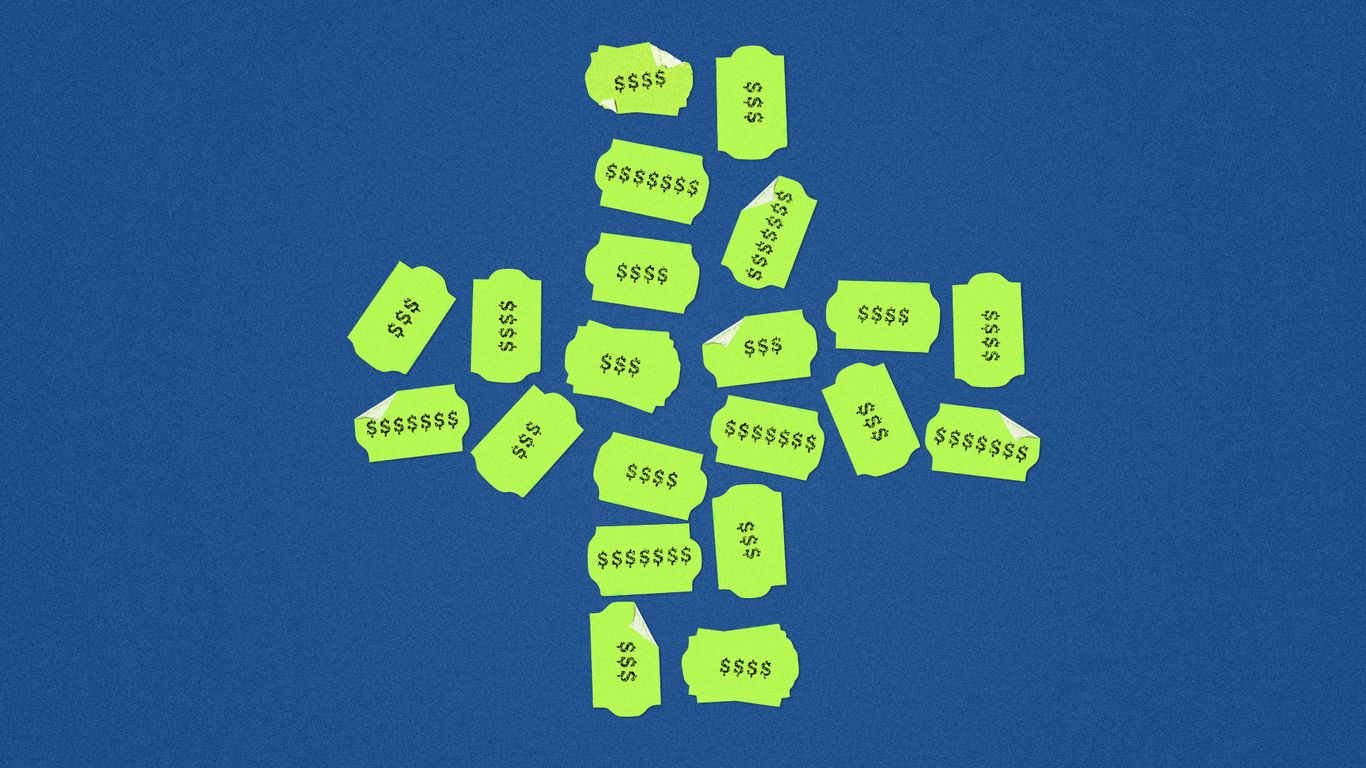

Wallet Warning: How Skyrocketing Healthcare Expenses Will Squeeze Workers in 2024

In a significant shift, corporations are increasingly pushing back against the traditional model of comprehensive health care coverage. Employees are now facing a new reality where they're bearing more of the financial burden for their medical expenses.

Companies are rapidly moving away from fully subsidized health plans, instead implementing strategies that transfer a larger portion of healthcare costs directly to workers. This trend reflects a broader corporate strategy to manage rising medical expenses and maintain financial flexibility.

The changing landscape means employees must now be more financially prepared and strategic about their healthcare choices. High-deductible plans, increased co-pays, and reduced coverage are becoming the new norm, forcing workers to carefully evaluate their medical spending and insurance options.

This transformation is driven by escalating healthcare costs, which have outpaced inflation for years. Corporations are seeking sustainable ways to manage these expenses while still attempting to provide competitive benefits that attract and retain talent.

Employees are consequently being compelled to become more financially savvy, setting aside more personal funds for potential medical expenses and making more informed decisions about their healthcare consumption. The era of comprehensive, low-cost corporate health coverage is rapidly evolving, signaling a fundamental change in how workplace health benefits are structured and experienced.