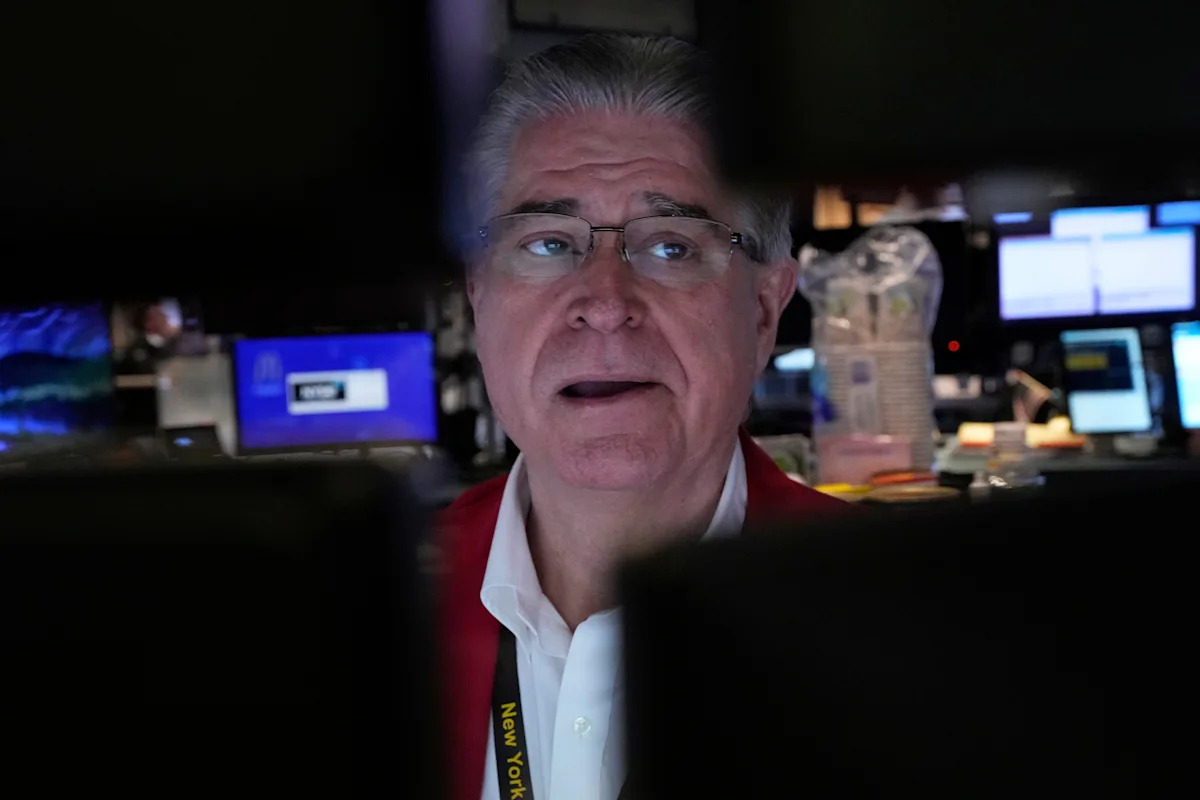

Wall Street's Bold Forecast: Morgan Stanley Predicts Triple Rate Cuts in 2024

In a bold prediction that's catching Wall Street's attention, Morgan Stanley is forecasting a series of interest rate cuts by the Federal Reserve in 2024. The investment bank's outlook comes on the heels of recent inflation data revealing a notable uptick in consumer prices during August—the most significant increase in seven months.

The financial giant suggests that despite recent economic fluctuations, the Fed is likely to implement rate reductions across all three of its upcoming meetings. This projection signals potential relief for borrowers and a strategic approach to managing economic challenges in the current financial landscape.

Investors and economic analysts are closely watching these developments, as Morgan Stanley's prediction could have far-reaching implications for mortgage rates, consumer lending, and overall economic strategy. The anticipated rate cuts could provide a much-needed boost to economic growth and consumer confidence in the coming months.