Crypto Loophole: How a $250 Island Residency Became My Regulatory Escape Hatch

Crypto Traders Discover Innovative Workaround: Palau's Digital Residency

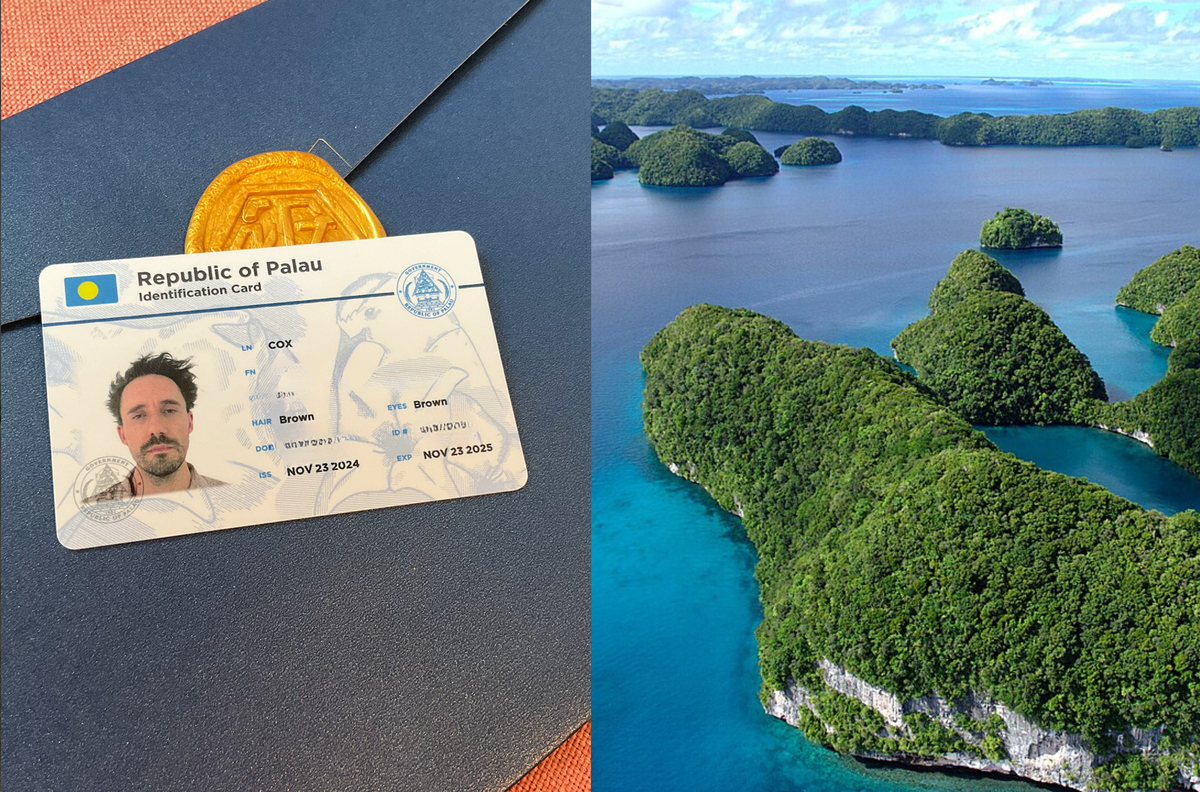

In a creative bid to bypass cryptocurrency withdrawal limits and exchange restrictions, U.S. traders are turning to an unexpected solution: digital residency in the Pacific island nation of Palau.

This emerging trend sees traders obtaining Palau's digital residency as a strategic method to circumvent the constraints imposed by major cryptocurrency platforms. By acquiring this unique digital identity, traders hope to gain more flexibility in managing their digital assets.

However, the strategy is not without complications. Major cryptocurrency exchanges have already begun blocking these digital residency credentials, anticipating potential abuse of the system. The exchanges are taking proactive measures to prevent traders from exploiting this loophole.

The move highlights the ongoing cat-and-mouse game between cryptocurrency traders and platforms seeking to maintain regulatory compliance. As restrictions tighten, innovative traders continue to seek alternative methods to maximize their trading capabilities.

While the long-term effectiveness of this approach remains uncertain, it underscores the cryptocurrency community's persistent creativity in navigating complex regulatory landscapes.