Digital Payment Showdown: CFPB Backs Down in Zelle Fraud Battle Against Banking Giants

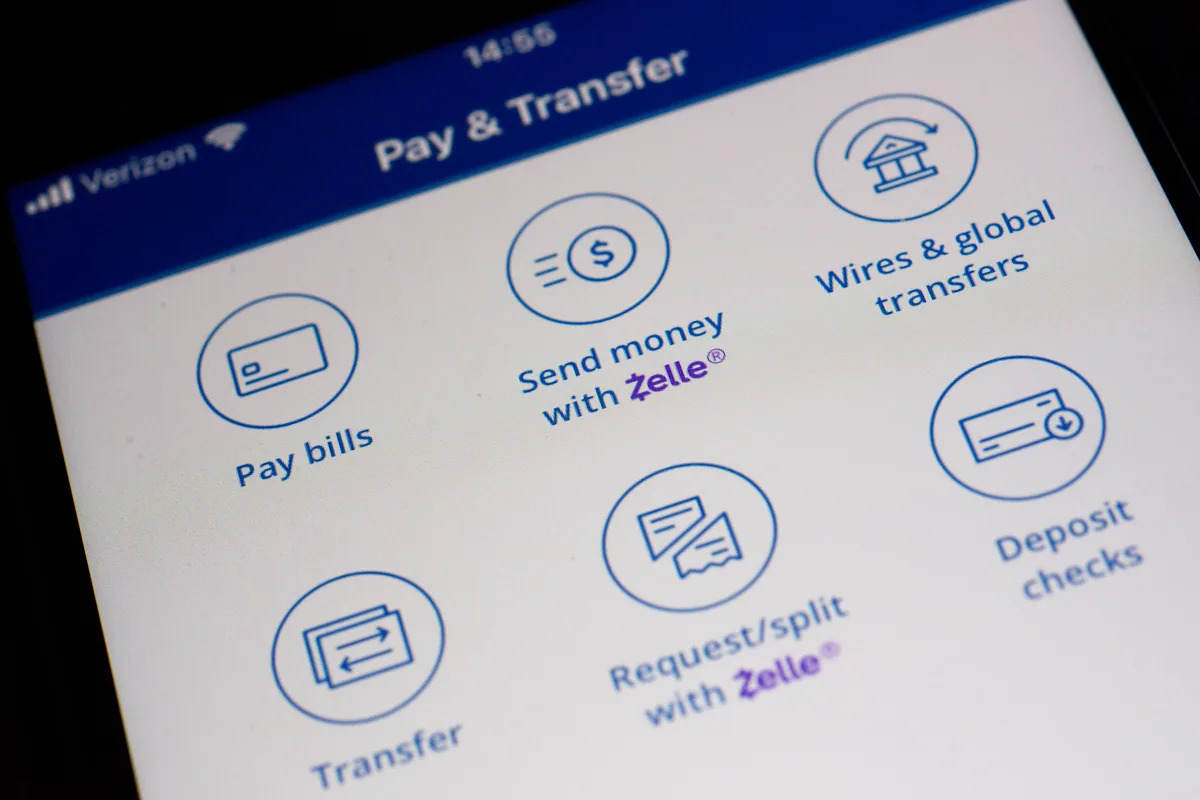

In a surprising turn of events, the Consumer Financial Protection Bureau (CFPB) has withdrawn its lawsuit against Early Warning Services, the company behind Zelle, and three major U.S. banks. This development comes amid a broader trend of federal agencies scaling back enforcement actions since President Donald Trump's return to the political landscape.

The original lawsuit, filed in December, targeted banking giants JPMorgan Chase, Wells Fargo, and Bank of America. The CFPB had initially accused these financial institutions of failing to protect consumers from widespread fraud on the Zelle payment platform, alleging violations of consumer financial protection laws.

At the heart of the complaint was a critical assertion that the banks hastily launched the peer-to-peer payment service without robust fraud prevention mechanisms. Moreover, the CFPB claimed that when consumers reported being victims of scams, the banks largely dismissed their claims and denied them financial relief.

The sudden withdrawal of the lawsuit raises questions about the changing regulatory environment and the potential implications for consumer protection in digital financial services. While the reasons behind the CFPB's decision remain unclear, it signals a potential shift in how financial misconduct is being addressed under the current administration.