Market Pulse: S&P 500's Critical Crossroads with the 200-Day Moving Average

Market Volatility Strikes: S&P 500 Tumbles Amid Trump's Tariff Tensions

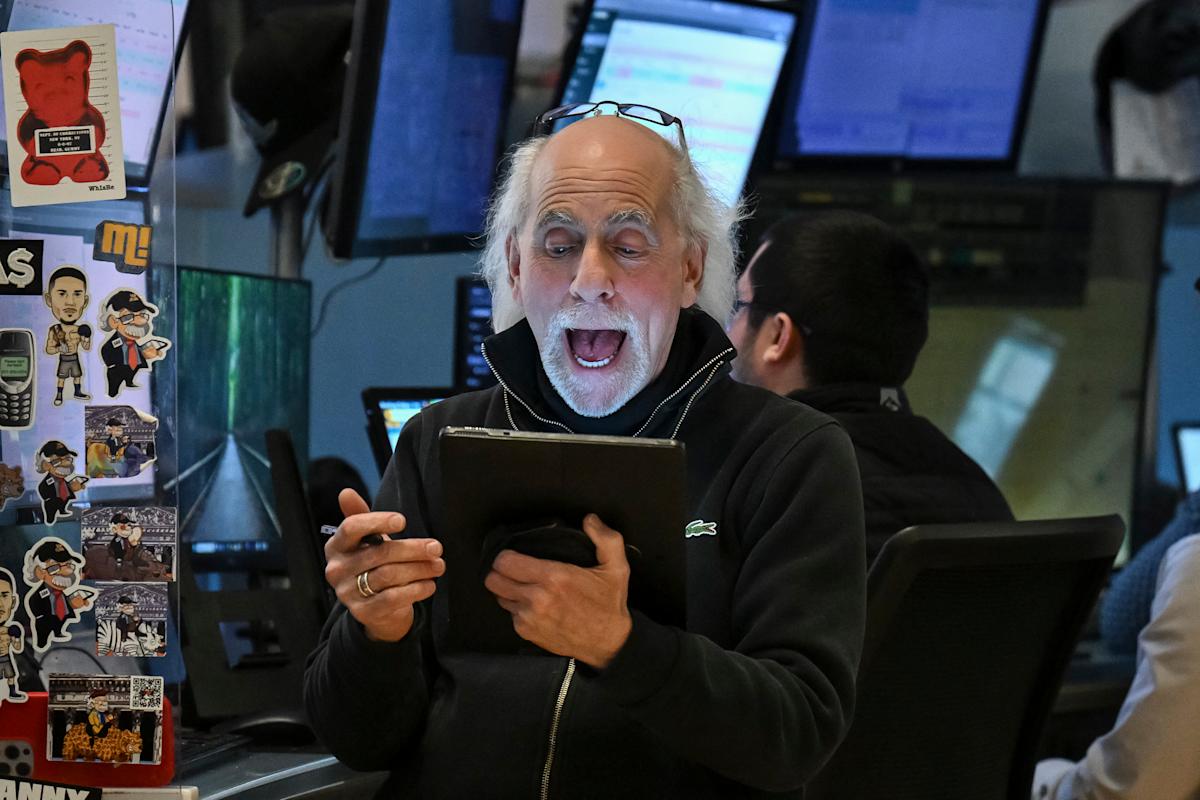

The stock market experienced another turbulent session on Tuesday, with the S&P 500 index plummeting 1.22% as investors grapple with escalating trade policy uncertainties. Yahoo Finance host Julie Hyman delved into the market's current dynamics, focusing on a critical technical indicator: the 200-day moving average.

Hyman's expert analysis reveals a significant market trend emerging as the S&P 500 breaks away from its recent momentum patterns. The 200-day moving average serves as a crucial benchmark, offering insights into the index's long-term performance and potential future direction.

Investors and market watchers are closely monitoring how President Trump's latest tariff policies are influencing market sentiment and driving the ongoing sell-off. The combination of geopolitical tensions and technical market signals is creating a complex landscape for traders and analysts.

For more in-depth market insights and expert commentary, tune into Yahoo Finance's "Asking for a Trend" series, where professionals break down the latest market movements and provide valuable perspectives on current economic trends.