Wall Street's Pulse: Jobs Report Could Make or Break Stock Market's Fragile Momentum

Wall Street Braces for Potential Market Surge on Jobs Report

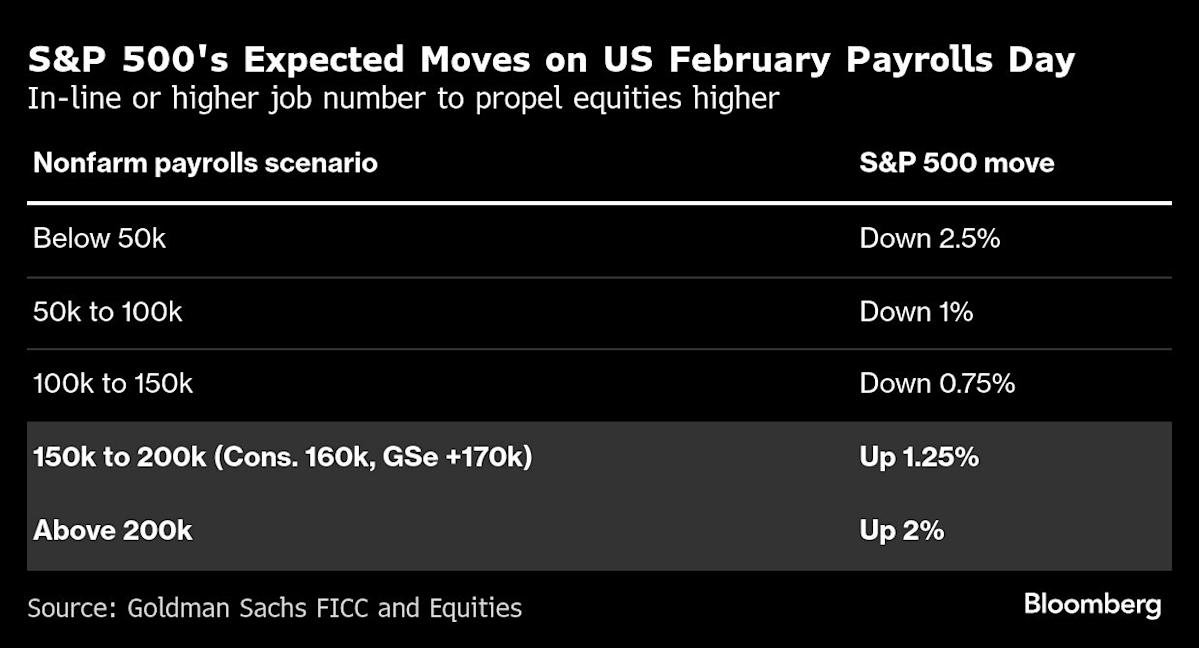

In a surprising twist, Goldman Sachs suggests that the current market pessimism might actually set the stage for a significant stock market rally. The investment giant's trading desk predicts that even a marginally positive US jobs report could trigger an unexpected surge in the S&P 500.

The current investor sentiment has been overwhelmingly negative, creating a unique market dynamic where even modest good news could spark substantial market movement. This suggests that expectations have been set so low that any hint of economic resilience could prompt a swift and dramatic market response.

Investors and market analysts are now closely watching the upcoming jobs data, anticipating that even a slight deviation from pessimistic forecasts could lead to a notable uptick in stock prices. The potential rally underscores the current market's sensitivity to economic indicators and the complex interplay between investor psychology and financial performance.

As traders and investors prepare for the report, the Goldman Sachs insight offers a glimmer of hope in an otherwise cautious market landscape, highlighting the potential for unexpected positive momentum.