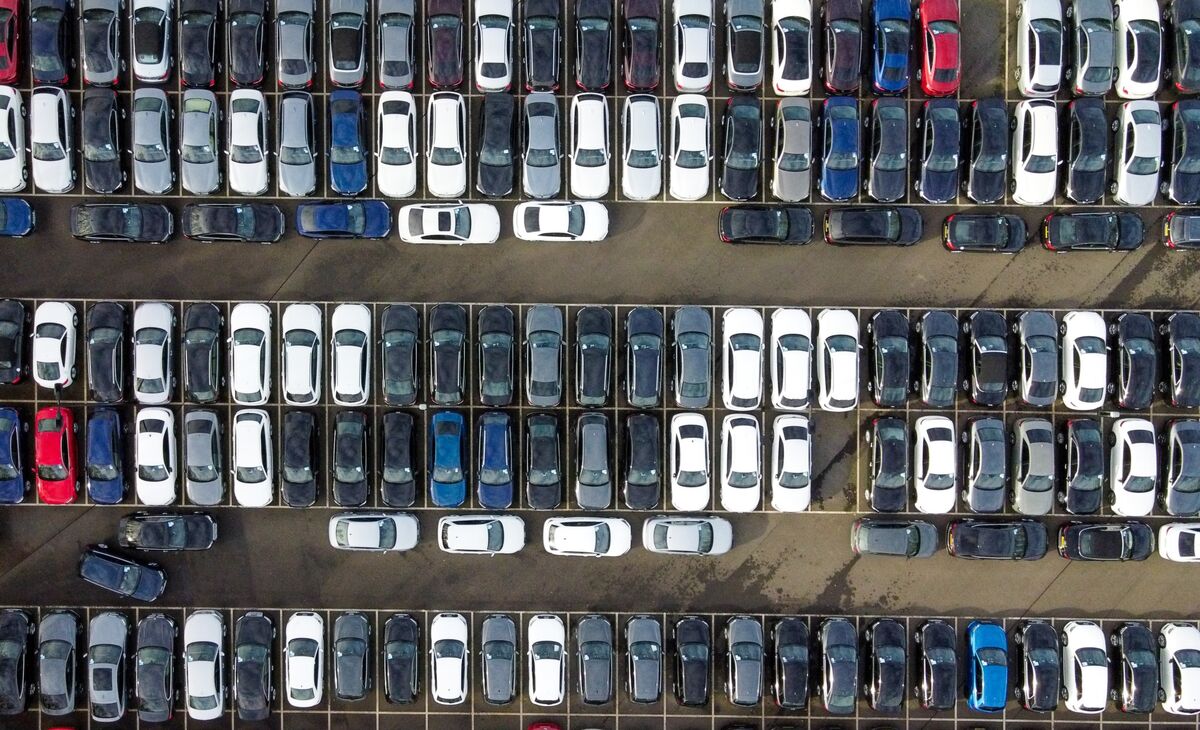

Motor Finance Scandal: UK Weighs Compensation Plan for Millions of Drivers

In a significant move to protect consumer interests, the UK's Financial Conduct Authority (FCA) is exploring the development of a comprehensive redress scheme targeting potential historical misconduct in motor finance sectors. The proposed framework would require banks to take decisive action if they uncover evidence of past practices that may have financially harmed consumers.

This potential new initiative signals the FCA's commitment to ensuring fair treatment and financial protection for individuals who might have been negatively impacted by questionable banking practices in the motor finance industry. By establishing a structured redress mechanism, the regulatory body aims to hold financial institutions accountable and provide a clear path for consumer compensation.

The proposed scheme represents a proactive approach to addressing historical financial irregularities, demonstrating the FCA's ongoing efforts to maintain transparency and integrity within the banking sector. As details of the potential redress framework continue to emerge, consumers and financial institutions alike are closely monitoring the developments.