Money Shield Down: Your Personal Finance Survival Guide in a Changing Regulatory Landscape

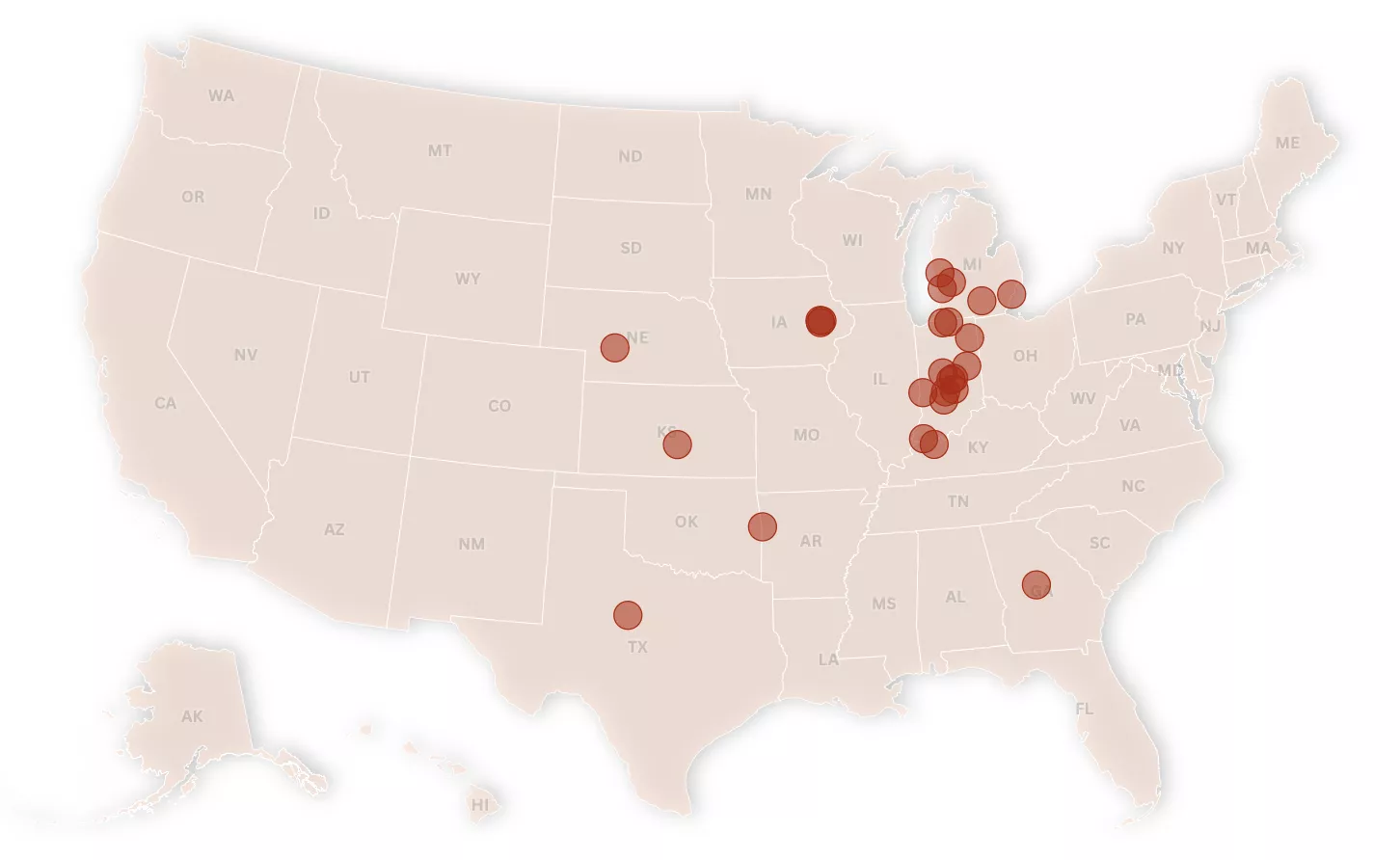

As the Trump administration seeks to undermine the Consumer Financial Protection Bureau (CFPB), consumer advocates are calling on borrowers to become their own financial guardians. With regulatory protections potentially weakening, individuals must now take proactive steps to safeguard their financial interests.

The CFPB, once a powerful watchdog for consumer financial rights, is facing unprecedented challenges. As political winds shift and regulatory oversight potentially diminishes, borrowers are being urged to become more vigilant and informed about their financial choices.

Key strategies for self-protection include:

• Carefully reviewing all financial agreements

• Monitoring credit reports regularly

• Understanding the fine print in loan and credit documents

• Researching financial products before committing

• Maintaining strong communication with lenders

While institutional protection may be wavering, individual empowerment remains a potent defense. By educating themselves and staying alert, consumers can create a personal shield against potential financial predation.

The message is clear: In an era of uncertain consumer protections, knowledge and proactive management are your most reliable allies in navigating the complex financial landscape.