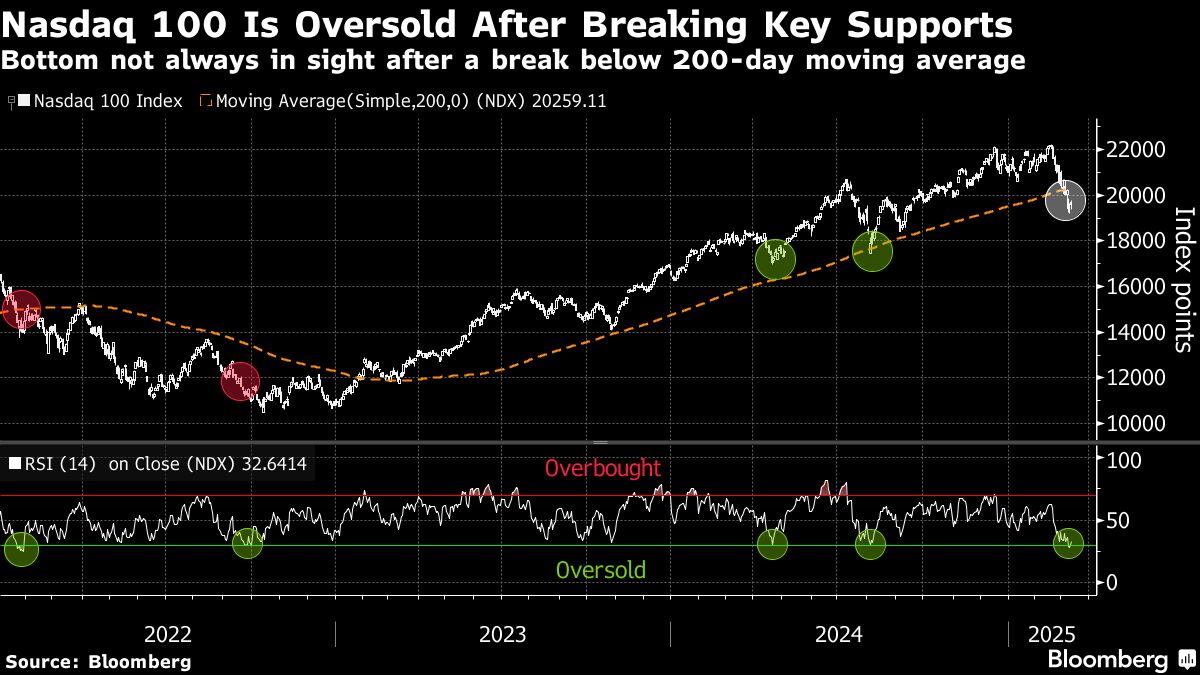

Market Turning Point: JPMorgan Signals End of Stock Market Downturn

JPMorgan Signals Potential End to US Equity Market Correction

Financial experts at JPMorgan Chase & Co. suggest that the recent downturn in US equity markets may be reaching its conclusion, with promising indicators emerging from credit markets that hint at a reduced likelihood of an economic recession.

The investment banking giant's analysis points to stabilizing credit conditions as a key signal of potential market recovery. By closely examining credit market dynamics, JPMorgan's analysts believe investors might be witnessing the early stages of a market stabilization period.

This assessment comes at a critical time when investors have been anxiously monitoring economic indicators for signs of potential economic turbulence. The credit market's current state suggests a more optimistic outlook compared to previous predictions of widespread economic downturn.

While market volatility remains a concern, JPMorgan's insights offer a glimmer of hope for investors seeking reassurance in an uncertain financial landscape. The bank's research team recommends cautious optimism and continued close monitoring of economic trends.