Crypto Craze: Why MARA Holdings Could Be Your Next Investment Goldmine

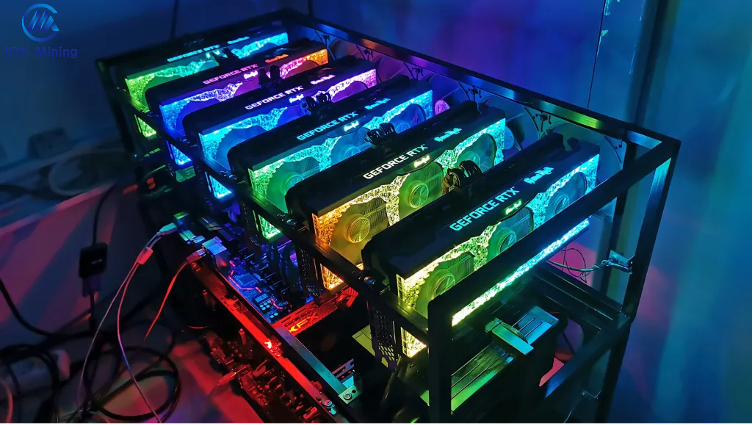

MARA Holdings Inc.: A Deep Dive into the Cryptocurrency Stock Landscape

In the ever-evolving world of digital finance, cryptocurrency stocks continue to capture investors' attention. Following our recent comprehensive guide to the top 13 cryptocurrency stocks, we're taking a closer look at MARA Holdings Inc. (NASDAQ:MARA) and its position in this dynamic market.

As the cryptocurrency ecosystem experiences rapid transformations, MARA Holdings stands out as a compelling player in the digital asset investment space. The recent market movements, particularly in the wake of significant political and economic announcements, have created an intriguing landscape for cryptocurrency-related stocks.

Investors are increasingly curious about how MARA Holdings compares to other leading cryptocurrency stocks. Its performance, strategic positioning, and potential for growth make it a noteworthy consideration for those looking to diversify their investment portfolio with digital asset exposure.

Our in-depth analysis explores the unique characteristics that set MARA Holdings apart in the competitive cryptocurrency stock market. From technological innovations to market adaptability, we'll break down the key factors that make this stock an interesting prospect for forward-thinking investors.

Stay tuned as we unpack the potential of MARA Holdings and its place in the broader cryptocurrency stock ecosystem.