Beyond the Hype: Are Stablecoins Really Transforming Business Transactions?

Stablecoins: The Unsung Heroes of Cryptocurrency Markets

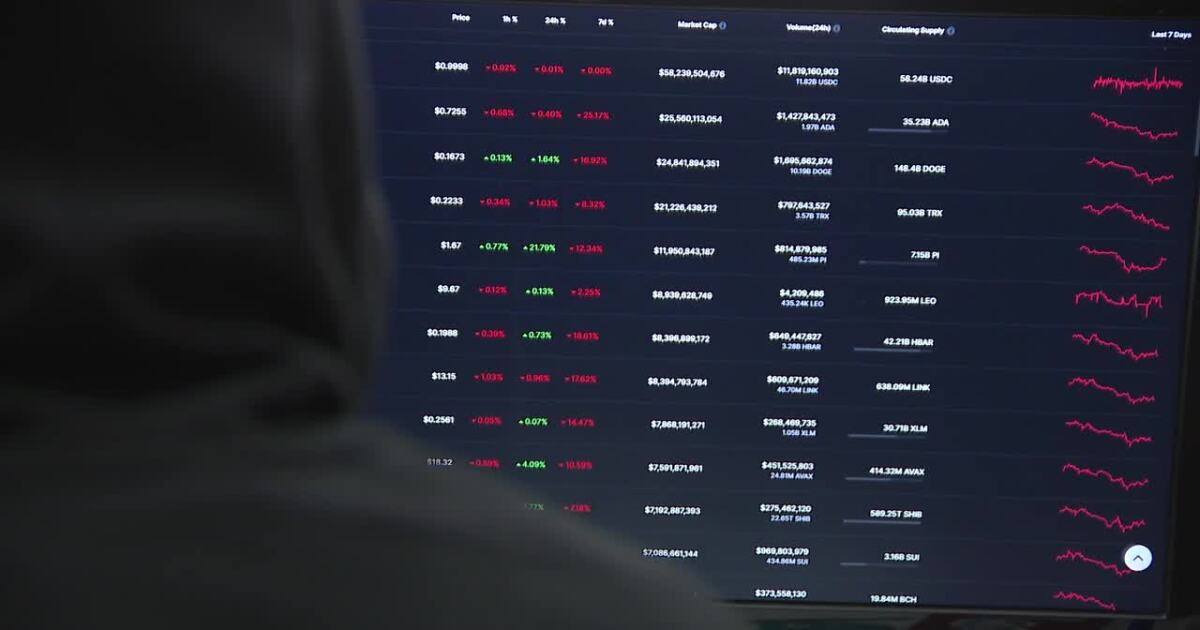

For years, stablecoins have quietly revolutionized the cryptocurrency landscape, emerging as the critical stabilizing force in an otherwise unpredictable digital financial ecosystem. These unique digital assets have become the backbone of crypto trading, offering traders and investors a much-needed anchor of predictability amid the wild price swings that characterize traditional cryptocurrency markets.

Unlike volatile cryptocurrencies that can experience dramatic price fluctuations in mere hours, stablecoins maintain a consistent value, typically pegged to traditional currencies like the US dollar. This stability transforms them into an essential tool for traders seeking to navigate the complex and often turbulent world of digital assets. They provide a safe haven during market turbulence, allowing investors to quickly move funds between exchanges and preserve value without converting to traditional banking systems.

By bridging the gap between traditional finance and the cutting-edge world of digital currencies, stablecoins have become more than just a trading mechanism—they're a fundamental infrastructure that enables smoother, more reliable cryptocurrency transactions. Their role in providing liquidity and reducing market volatility cannot be overstated, making them a crucial component of the modern cryptocurrency ecosystem.