Wall Street Trembles: Trump's High-Stakes Market Gamble Raises Alarms

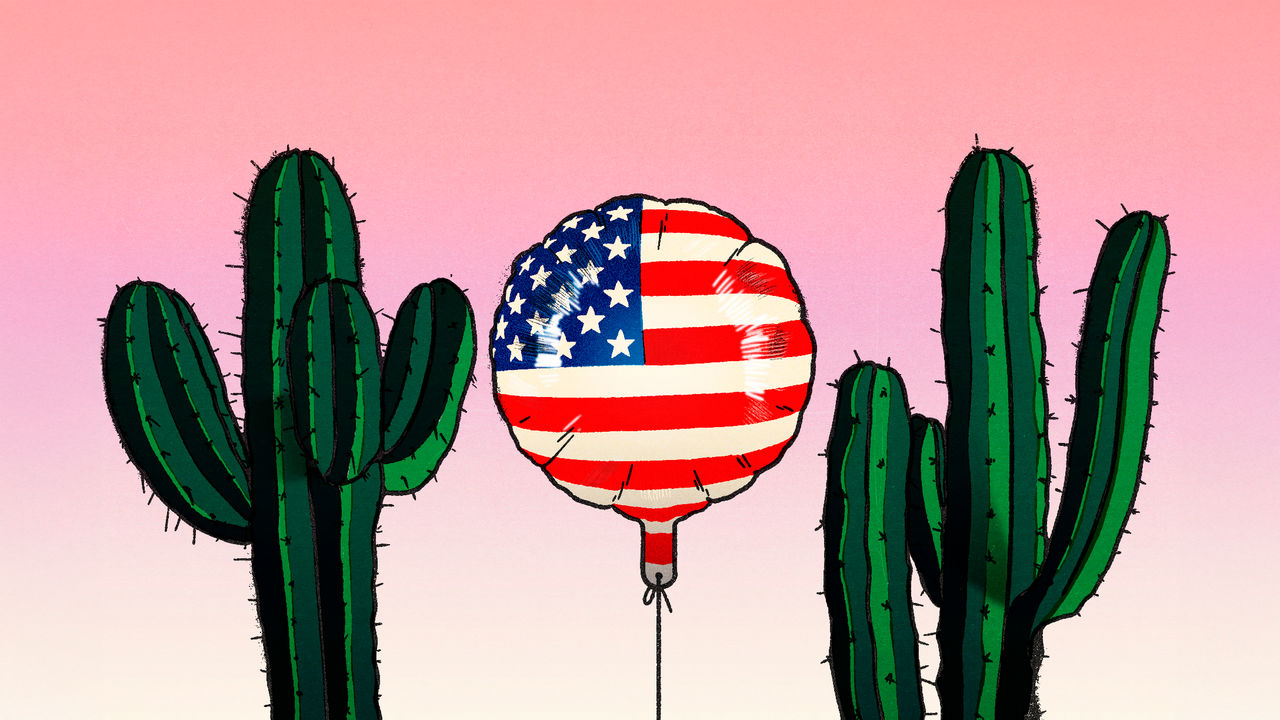

The American investment landscape stands on precarious ground, with investors facing potentially significant financial risks that could send ripples through the entire economic ecosystem. Recent market indicators suggest an unprecedented level of vulnerability, positioning both individual portfolios and broader economic structures at a critical juncture.

Mounting economic pressures have created a perfect storm of uncertainty, where investors are increasingly exposed to potential market downturns. The delicate balance of investment strategies, coupled with volatile market conditions, means that even a modest sell-off could trigger substantial financial repercussions.

Experts warn that the current investment climate is characterized by heightened risk, with many portfolios heavily concentrated in sectors that could quickly unravel under economic stress. This concentration creates a domino effect where individual investor exposure could rapidly translate into wider economic instability.

The interconnected nature of modern financial markets means that a significant sell-off would not just impact Wall Street, but could potentially cascade through various economic sectors, challenging the resilience of the entire financial system. Investors and economic policymakers are closely monitoring these potential risks, understanding that prevention and strategic adaptation are crucial in navigating these turbulent financial waters.