Crypto Kingpin Cracks: Founder Admits to Orchestrating Massive Market Manipulation Plot

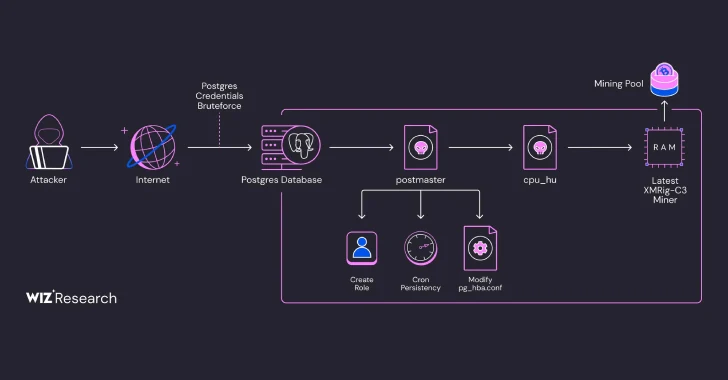

In a dramatic turn of events, Aleksei Andriunin, the founder and CEO of cryptocurrency market-making firm Gotbit, has admitted to orchestrating a sophisticated market manipulation scheme that sent shockwaves through the digital finance world.

During a federal court hearing in Boston, Andriunin and his company entered guilty pleas to charges of deliberately manipulating cryptocurrency markets to benefit their client companies. The confession reveals a calculated strategy to artificially influence digital token valuations, potentially undermining the transparency and integrity of cryptocurrency trading.

The case highlights the ongoing challenges in the largely unregulated cryptocurrency landscape, where market manipulation remains a significant concern for investors and regulators alike. Andriunin's admission provides a rare glimpse into the complex and often opaque world of digital asset trading.

By pleading guilty, Andriunin has acknowledged his role in a widespread scheme that could have significant implications for how market-making firms operate in the cryptocurrency ecosystem. The case serves as a stark reminder of the potential risks and ethical challenges inherent in the rapidly evolving world of digital finance.

As the legal proceedings continue, the cryptocurrency community and financial regulators will be closely watching the potential consequences of this landmark admission.