Financial Survival Guide: JP Morgan's Insider Strategies to Weathering a Potential Trump-Era Economic Storm

Economic downturns can send shivers through even the most financially stable households. A recession isn't just a dry economic term—it's a reality that can dramatically reshape lives, careers, and financial landscapes. When these economic contractions hit, they bring a cascade of challenges: job uncertainties, tightened credit markets, and widespread financial anxiety.

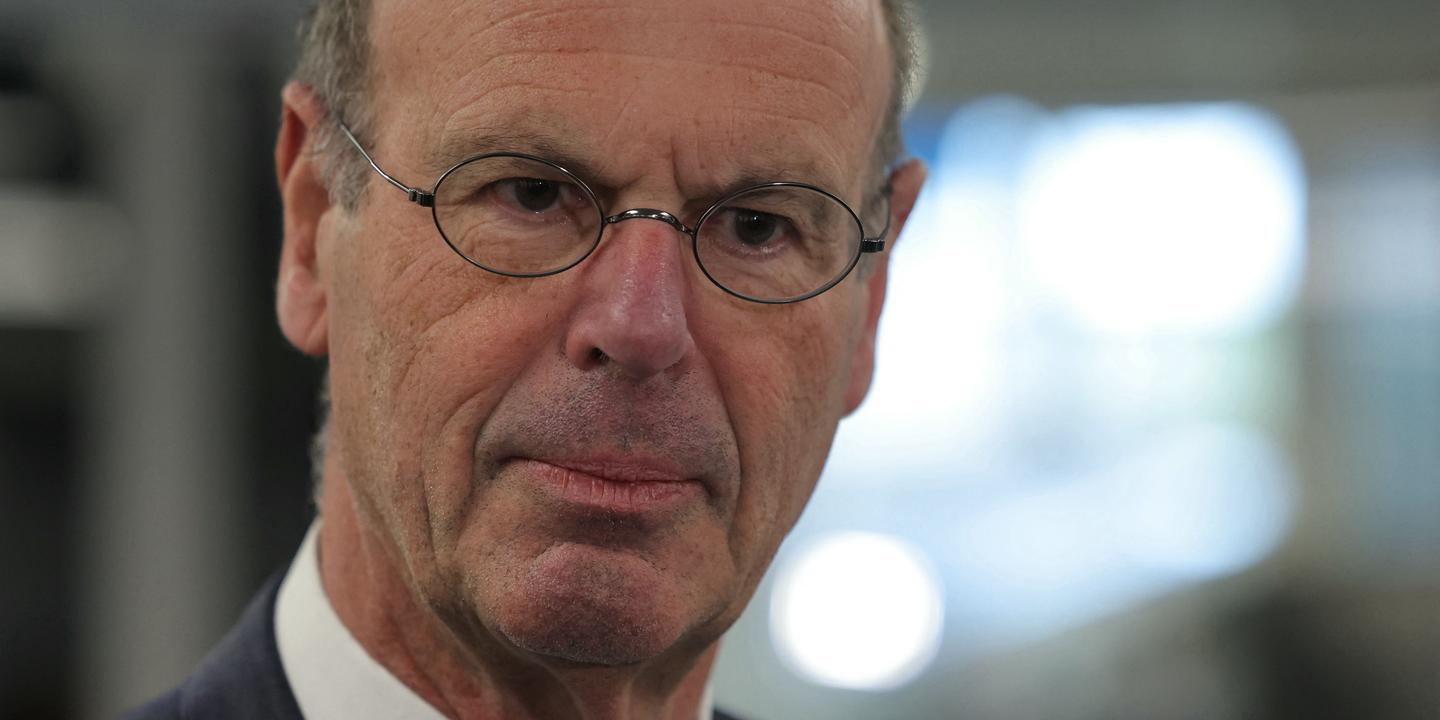

Recently, Bruce Kasman, the astute chief economist at J.P. Morgan, sparked conversations about potential economic shifts that could signal an impending slowdown. His insights shed light on the complex dynamics that can trigger and sustain a recessionary period, offering a nuanced perspective on what consumers and businesses might expect.

While recessions are inherently challenging, they're also natural economic cycles that can ultimately lead to structural improvements and more resilient economic systems. Understanding their mechanics can help individuals and organizations better prepare and navigate these turbulent financial terrains.

The key is not to fear these economic fluctuations but to approach them with strategic planning, adaptability, and a forward-looking mindset.