Crypto Crackdown Reversal: US Lifts Sanctions on Russian Digital Money Middleman

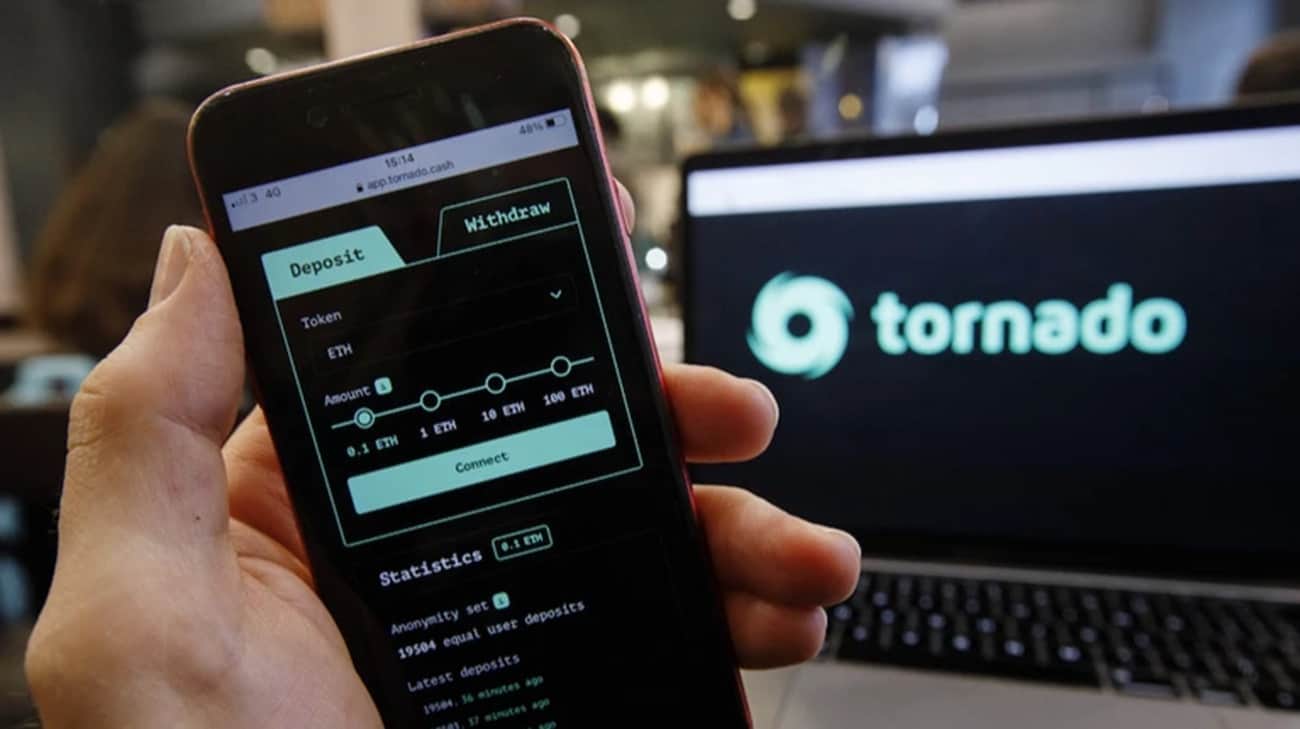

In a significant development for the cryptocurrency world, the US Office of Foreign Assets Control (OFAC) has made a notable shift in its stance towards Tornado Cash. The crypto mixing service, which was previously under strict sanctions, has been removed from the sanctioned entities list. Additionally, the regulatory body has softened its approach to the service's Russian founder.

Tornado Cash, a decentralized crypto mixing platform, had been at the center of controversy since its sanctioning in August 2022. The OFAC's recent decision marks a potential turning point for the service, which had been under intense scrutiny for its alleged role in money laundering and illicit financial activities.

The easing of sanctions suggests a more nuanced approach by US regulators to cryptocurrency privacy tools, potentially signaling a more balanced perspective on the complex intersection of financial privacy and regulatory compliance.

While the full implications of this decision are still unfolding, it represents an important moment for the cryptocurrency ecosystem, highlighting the ongoing dialogue between innovative blockchain technologies and regulatory frameworks.