Crypto Freedom: Kentucky Blazes Trail with Groundbreaking Digital Asset Protection Law

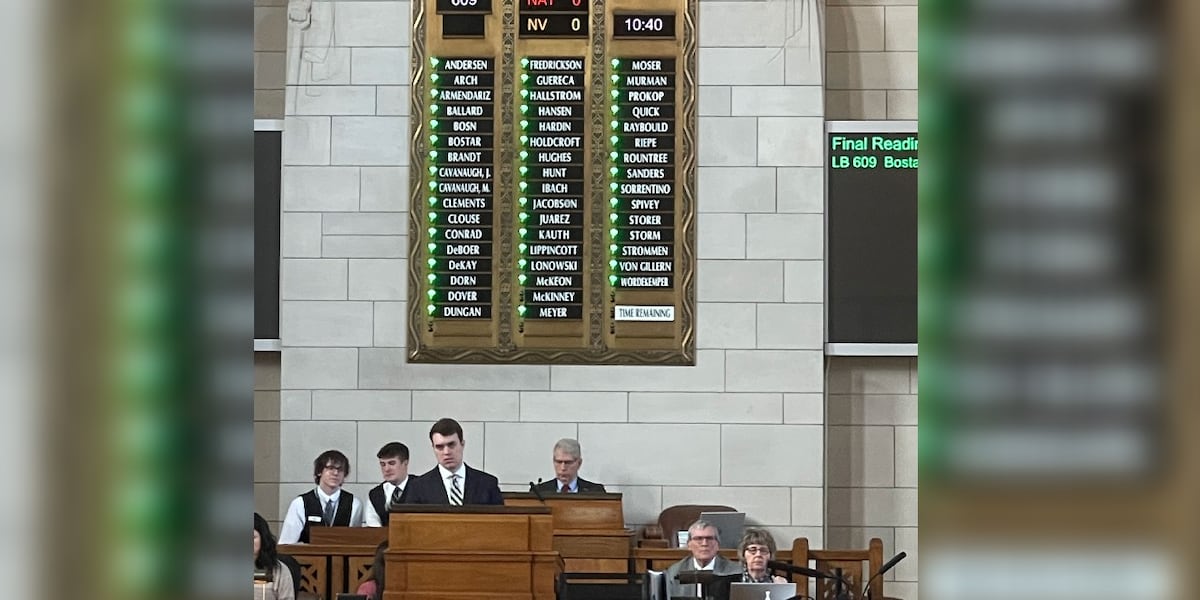

Kentucky Blazes a Trail: Landmark Legislation Empowers Crypto Investors with Digital Asset Protection

In a groundbreaking move, Kentucky has positioned itself at the forefront of cryptocurrency regulation by passing a pioneering law that guarantees individuals' rights to self-custody digital assets. This progressive legislation provides crucial legal safeguards for Bitcoin and cryptocurrency holders, signaling a significant step towards mainstream acceptance of decentralized finance.

The new law offers unprecedented clarity and protection for crypto investors, ensuring they maintain full control and ownership of their digital assets. By explicitly recognizing the rights of individuals to manage their cryptocurrencies without undue interference, Kentucky has set a powerful precedent that could inspire similar legislation in other states.

As the national conversation around digital currencies continues to evolve, this landmark legislation demonstrates Kentucky's commitment to fostering innovation and providing a secure legal framework for emerging financial technologies. Crypto enthusiasts and investors can now feel more confident in their digital asset strategies, knowing they have robust legal backing.

This forward-thinking approach not only protects individual investors but also signals Kentucky's potential to become a hub for blockchain and cryptocurrency innovation. By proactively addressing the legal complexities of digital assets, the state is creating an attractive environment for technological advancement and financial entrepreneurship.

:max_bytes(150000):strip_icc()/INV_crypto_stack-973039438-c42d164c513f4eea92c9854c751c5167-c57f1eb670204fa182c8a6d24f2a46dd.jpg)