Notion's Money Management Maze: Why Your Wallet Might Want to Look Elsewhere

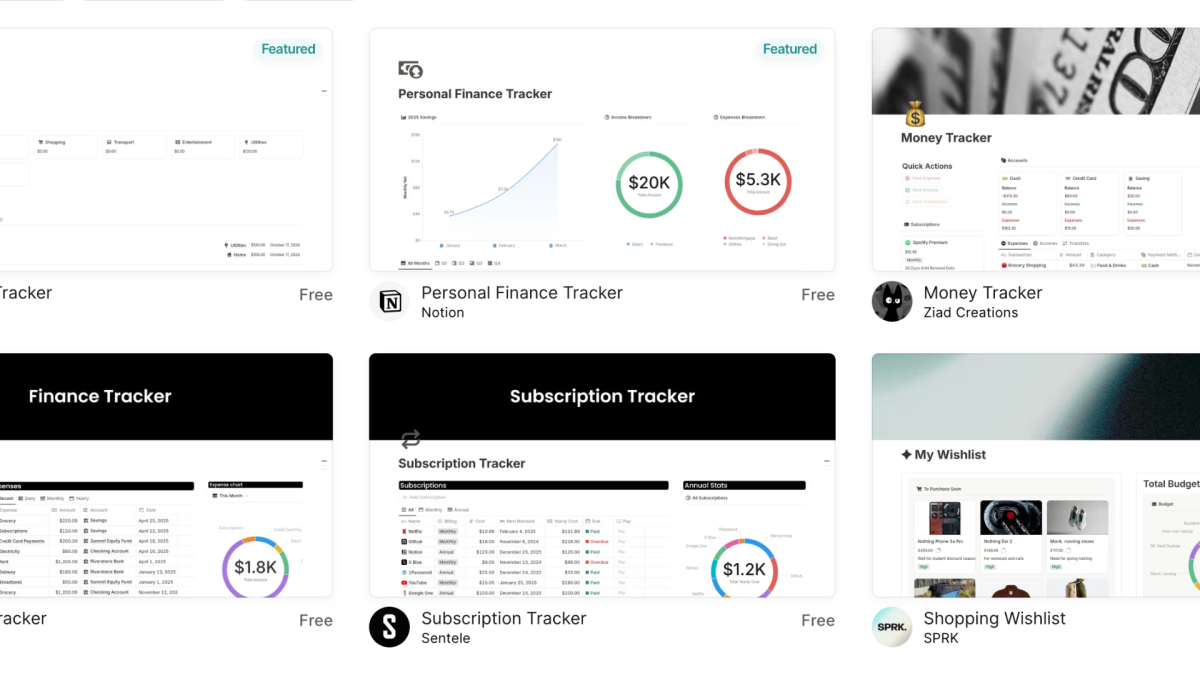

Navigating Personal Finance with Narrative and Nuance: Why Notion Matters For those who don't just see numbers, but weave financial stories—individuals who process monetary decisions through context, visualization, and holistic life planning—Notion emerges as a transformative tool. While it may not completely replace specialized financial software for intricate money management, Notion serves as an intelligent, adaptable companion on your financial wellness journey. Imagine a platform that doesn't just track dollars and cents, but understands the human narrative behind each transaction. Notion bridges the gap between cold, hard data and the rich, personal context of your financial choices. It's perfect for visual thinkers who crave organized insights, storytellers who want their financial documentation to reflect their life's broader tapestry, and pragmatic planners seeking an integrated approach to tracking wealth and goals. More than a spreadsheet, Notion becomes a dynamic financial storytelling canvas—where numbers meet meaning, and personal finance becomes a truly personalized experience.