Sustainable Investing Under Siege: ESG Finance Faces Political Firestorm

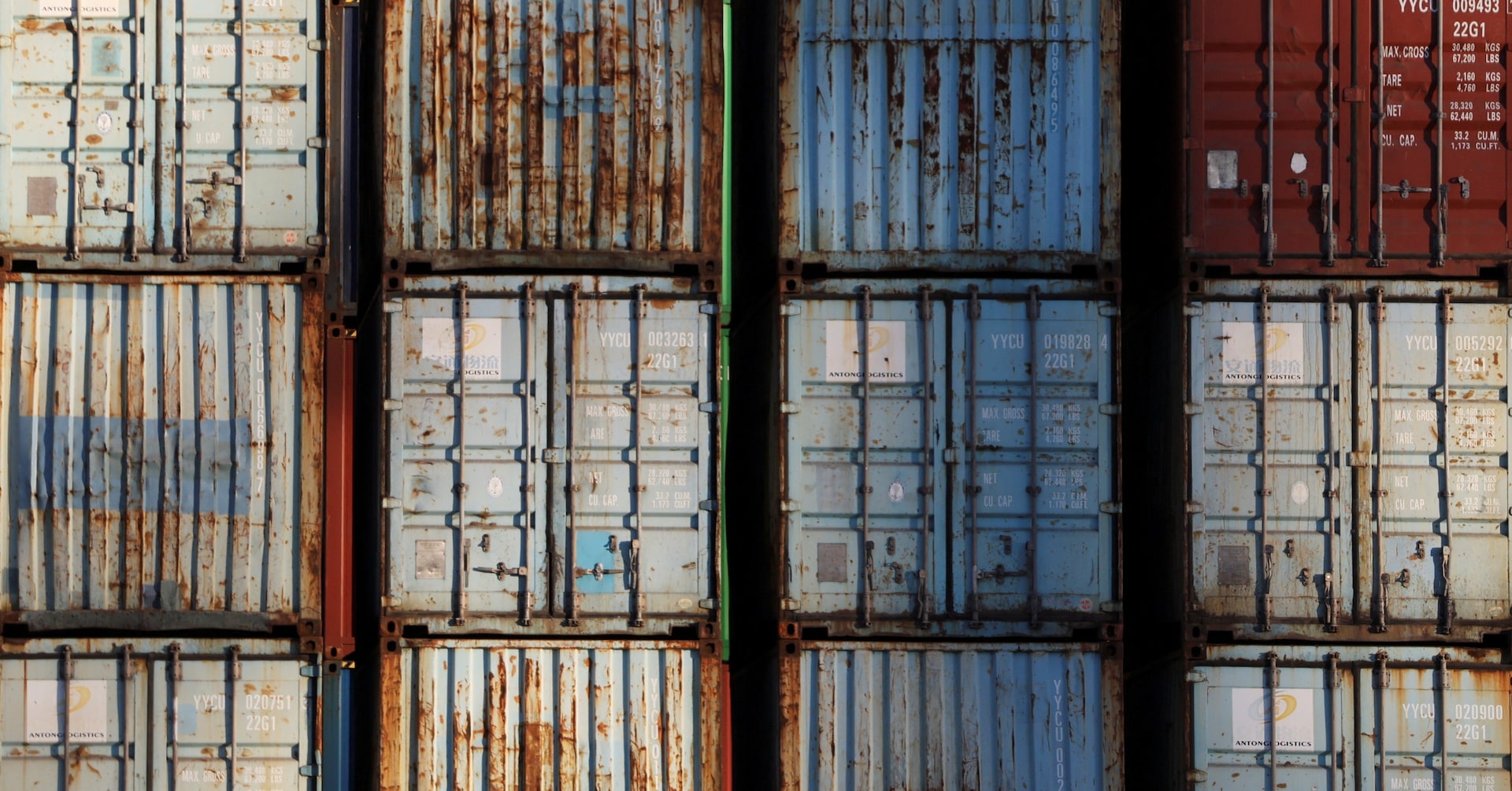

The global industrial landscape finds itself at a critical crossroads, navigating complex geopolitical and environmental tensions. As the potential return of President Trump looms, the United States is experiencing a significant pushback against sustainable investment principles, creating a stark contrast with European investors' unwavering commitment to green strategies. The emerging scenario presents a fascinating dichotomy: American industrial sectors are witnessing a potential rollback of environmental regulations, while European markets continue to double down on sustainable development and climate-conscious investments. This divergence highlights the increasingly polarized approach to economic growth and environmental responsibility. European investors remain steadfast in their dedication to sustainable principles, viewing long-term environmental strategies as crucial for future economic resilience. In contrast, the potential Trump administration resurgence signals a potential return to more traditional, fossil fuel-friendly policies that could dramatically reshape the industrial investment landscape. The tension between these opposing forces creates an unprecedented moment of uncertainty for global industries, challenging companies to navigate increasingly complex political and environmental expectations. As stakeholders watch closely, the coming months promise to be a critical period of transformation and strategic realignment in the global industrial sector.