Crypto Exchanges: The Digital Disruptors Reshaping Financial Technology

Cryptocurrency Exchanges: Revolutionizing the Fintech Landscape

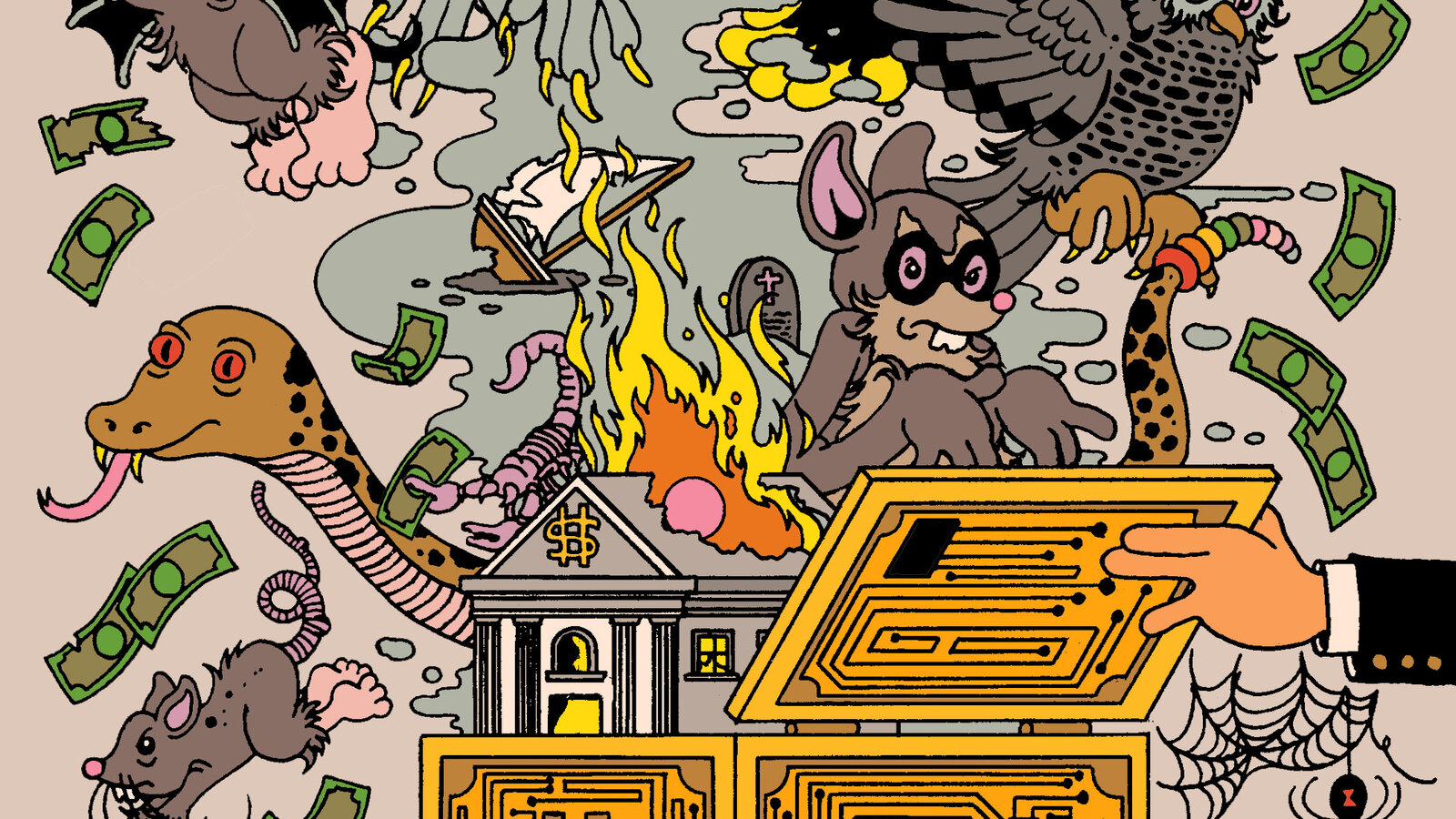

In the rapidly evolving world of digital finance, cryptocurrency exchanges have emerged as powerful catalysts of transformation, fundamentally reshaping how we perceive and interact with financial technologies. These innovative platforms are not just trading venues, but dynamic ecosystems that are driving unprecedented innovation across the fintech industry.

At the heart of this revolution lies the ability of cryptocurrency exchanges to break down traditional financial barriers. By providing seamless, decentralized, and globally accessible trading platforms, they are democratizing financial access and empowering individuals who were previously excluded from sophisticated investment opportunities.

Key Impacts on Fintech Innovation

- Technological Advancement: Cryptocurrency exchanges are pushing the boundaries of blockchain technology, creating more secure, transparent, and efficient financial systems.

- Financial Inclusion: These platforms are opening doors for millions worldwide, offering alternative investment and financial services beyond traditional banking.

- Regulatory Evolution: The rise of crypto exchanges is compelling regulators to develop more adaptive and forward-thinking financial frameworks.

As we look to the future, cryptocurrency exchanges are poised to continue their transformative journey, driving digital finance towards a more interconnected, accessible, and innovative landscape. The fintech industry stands at the cusp of a remarkable revolution, with these exchanges leading the charge.